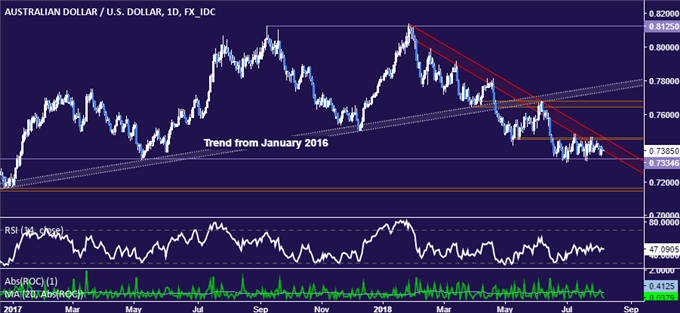

AUD/USD Technical Strategy: NET SHORT AT 0.7547

- Australian Dollar edging to range support before RBA policy decision

- Overall trend bearish, breakdown to expose double bottom below 0.72

- Wait-and-see approach favored for short AUD/USD position for now

Join our free webinar to follow the RBA rate decision and its impact on AUD/USD live !

The Australian Dollar is edging toward the bottom of a two-month consolidation range ahead of the looming RBA monetary policy announcement. The currency has struggled to establish near-term direction against its US counterpart but overall trend positioning argues for a firmly bearish bias.

From here, a daily close below chart inflection point support at 0.7335 paves the way for a challenge of double bottom support in the 0.7145-65 area. Alternatively, a push above resistance in the 0.7452-61 zone would invalidate immediate downside pressure and open the door for a test above the 0.76 figure.

The short AUD/USD trade activated at 0.7608 and then scaled up near 0.7530 remains in play. The current setup doesn’t offer compelling reasons to exit the position or add to it. Perhaps the RBA rate decision will offer impetus for a breakout, but opting for a wait-and-see approach seems sensible in the interim.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter