AUD/USD Technical Strategy: NET SHORT AT 0.7547

- Aussie Dollar is still treading water in a choppy range vs US namesake

- Down trend resistance is intact, suggesting overall bias favors weakness

- Wait-and-see approach favored until prices break free of congestion

See our free guide to get help building confidence in your AUD/USD trading strategy !

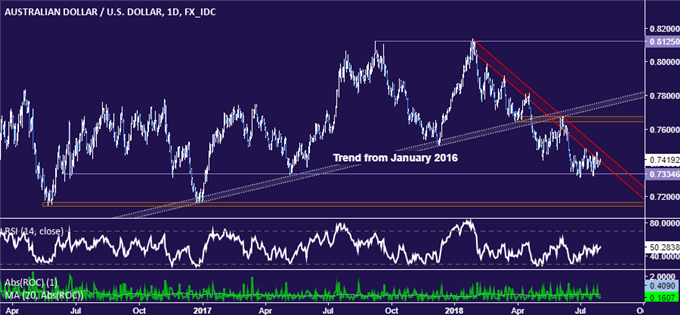

The Australian Dollar continues to be confined to a choppy range against its US namesake but broader positioning favors bearish trend resumption. Price action has been defined by a series of lower highs and lows since setting a double top near the 0.81 figure in late January. Until that is conclusively invalidated, the path of least resistance is seen leading downward.

Immediate support remains at 0.7335, a chart inflection point in play since mid-June 2016. Breaking below this barrier on a daily closing basis opens the door for another challenge of double bottom support in the 0.7145-65 area. Alternatively, a break above the outer bound of trend resistance – now at 0.7483 – paves the way for a foray back above the 0.76 figure.

The short AUD/USD position triggered at 0.7608 and subsequently scaled up near 0.7530 continues to be in play. Current positioning offers neither a convincing argument for near-term downward trend resumption nor compelling evidence of reversal. With that in mind, a wait-and-see approach seems most sensible for now until greater clarity emerges.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter