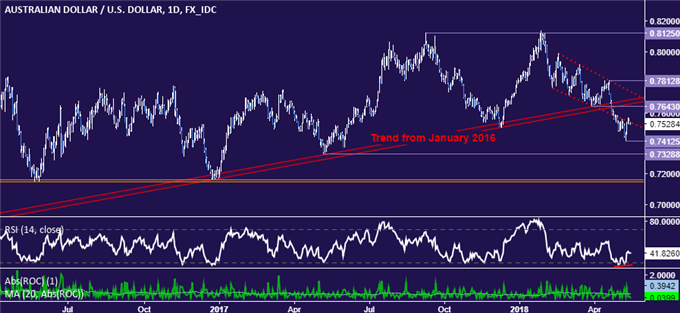

AUD/USD Technical Strategy: NET SHORT AT 0.7547

- Australian Dollar down move may be ready to regain momentum

- Break of counter-trend line follows hold at former resistance level

- Opting to add further to AUD/USD short position already in play

See our free guide to get help building confidence in your AUD/USD trading strategy !

The Australian Dollar may be on the cusp of another push lower against its US counterpart following a brief corrective recovery to retest former chart support. The next stage of the emerging down trend following a break of trend support from January 2016 may be about to take place.

A pair of Shooting Star candlesticks on the daily chart following a retest of wedge floor support-turned-resistance hints at indecision, warning that upside momentum might be ebbing. The setup is made more actionable by a break of counter-trend line support on the four hour chart.

Current positioning seems to present another opportunity to add to the AUD/USD short position initially entered at 0.7608, albeit an unexpected one in the context of last week’s scale-up. Still, the trade was taken and the next entry price is now 0.7547. A stop-loss will be triggered on a discretionary basis.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter