To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

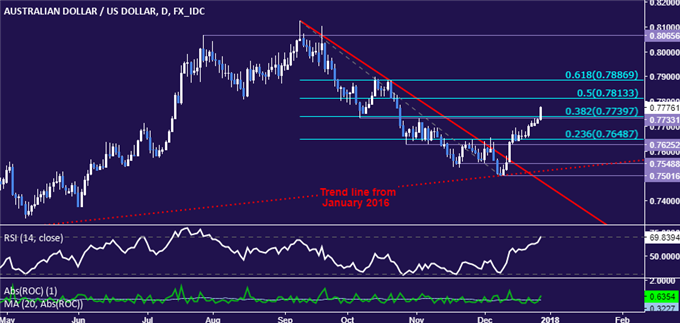

- AUD/USD Technical Strategy: Long at 0.7666

- Australian Dollar rises to highest level in two months vs. US counterpart

- Partial profit booked on long trade, remainder still in play to capture rally

The Australian Dollar soared to the highest level in two months against its US counterpart, with prices now seemingly poised to probe above the 0.78 figure. The move higher marks the eighth consecutive advance for the Aussie, making this the longest winning streak since October 2015.

Near-term resistance is at 0.7813, the 50% Fibonacci retracement, with a break above that on a daily closing basis opening the door for a test of the 61.8% level at 0.7887. Alternatively, a move back below the 0.7733-40 (38.2% Fib, October 6 low) exposes the 0.7625-49 zone (October 27 low, 23.6% retracement).

The long AUD/USD position triggered at 0.7666 hit its initial profit target and partial profit has been booked. The remainder of the trade remains in play to capture follow-on strength. The stop-loss has been trailed to the breakeven level.

What is the #1 mistake that traders make, and how can you fix it? Find out here !