To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

- Aussie Dollar forms bullish candlestick pattern, hinting a rebound may be ahead

- Bearish long-term trend break still valid, hinting gains may yet prove corrective

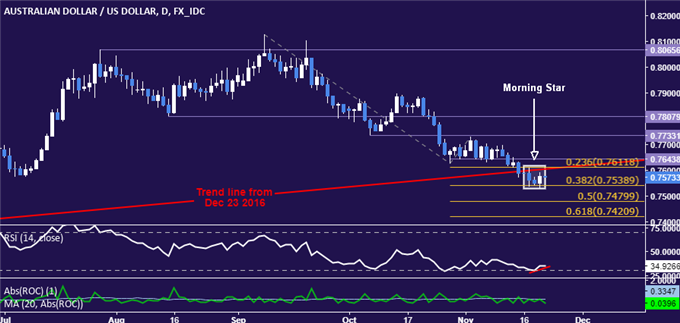

The Australian Dollar put in a bullish Morning Star candlestick pattern, hinting that a rebound against its US counterpart might be brewing ahead. Last week’s break of trend line support from December 2016 is yet to be invalidated however, keeping the near-term bias broadly bearish.

A daily close above the 23.6% Fibonacci expansion at 0.7611 would boost the case for a meaningful advance and expose support-turned-resistance at 0.7644, formerly a range floor. Alternatively, a turn lower that takes out the 38.2% level at 0.7539 sees the next downside threshold at 0.7480, the 50% Fib.

The short AUD/USD trade activated at 0.7590 hit its first target and partial profit was booked but remaining exposure was stopped out at breakeven. Confirmation of bullish reversal is absent for now but an actionable signal to re-enter short is likewise missing. With that in mind, opting to stand aside seems best for now.

Have a question about trading AUD/USD? Join a trading Q&A webinar and ask it live!