To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

- Australian Dollar remains perched at critical support, looking for direction

- Clear-cut breakout coupled with acceptable risk/reward needed for a trade

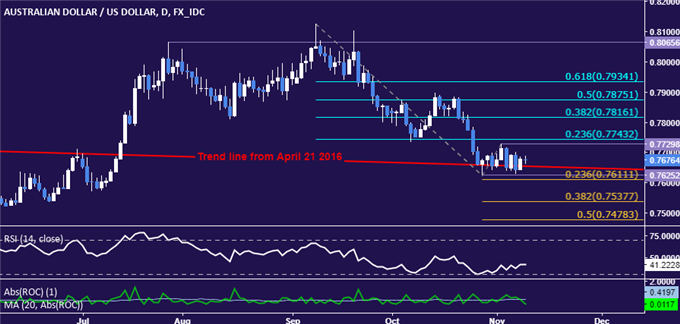

The Australian Dollar is perched at trend-defining support, with the currency yet to decide on near-term direction against its US counterpart. A series of descending highs and lows argues for a bearish near-term bias but the longer-term view warns that recent losses might have been corrective within a larger advance.

Support is in the 0.7611-25 area (October 27 low, 23.6% Fibonacci expansion), with a daily close below that exposing the 38.2% level at 0.7538 and arguing for a structural tone shift in favor of the downside. Alternatively, a breach of the 23.6% Fib retracement at 0.7743 targets the 38.2% mark at 0.7816.

Current positioning is inconclusive, with prices bumping around in a choppy range. A definitive break of immediate support or resistance is needed to make for an actionable setup technically, at which point risk/reward parameters can be assessed in search of a trade. In the meantime, staying flat seems prudent.

What do retail traders’ buy/sell decisions hint about coming AUD/USD moves? Find out here !