To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

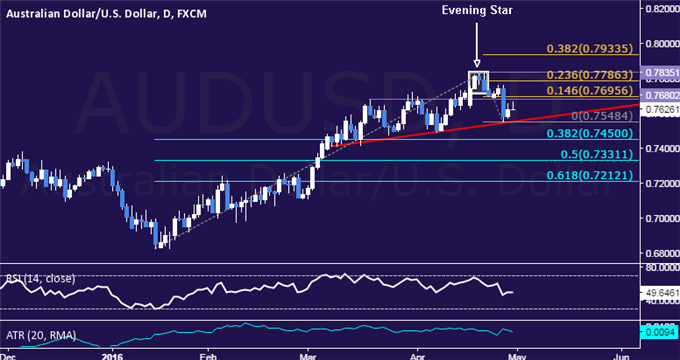

- Aussie Dollar selloff stalls as prices meet two-month trend line support

- Looking for a compelling opportunity to sell in line with long-term trend

The Australian Dollar has found interim support at trend support set from early march after falling against its US counterpart as expected. The decline followed the formation of a bearish Evening Star candlestick pattern and was catalyzed by soft first-quarter CPI figures.

From here, a daily close above the 14.6% Fibonacci expansion at 0.7696 opens the door for a test of the 0.7786-7835 area marked by the 23.6% level and the April 21 high. Alternatively, a push below the intersection of trend line support and the April 27 low at 0.7548 exposes the 38.2% Fib retracement at 0.7450.

We are keen to enter short AUD/USD in line with our 2016 fundamental forecast. An actionable trigger for a short position is absent at the moment however, arguing for patience. With that in mind, we will remain on the sidelines until a more compelling opportunity presents itself.

Are you making this common mistake trading AUD/USD? Find out here !