Daily

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader and see ideas on other USD crosses

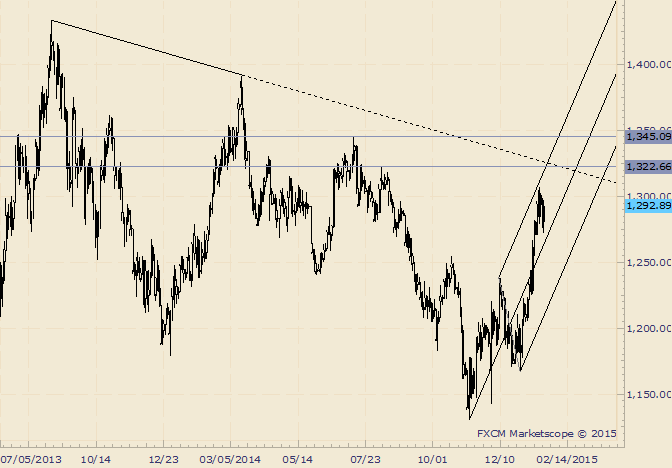

-“The sharp advance from the lows may indicate that a 5th wave terminal thrust is complete in gold.”

-“The invalidation level from the break of a multi-month inverse head and shoulders (target is 1345) is 1225. The December high may provide support at 1238.” Gold took out 1263 and the mentioned 1345 target is in focus. 1323 is possible resistance before the target and 1255/67 is now possible support.

--Tradingideas are availabletoJ.S. Trade Desk members.