Talking Points:

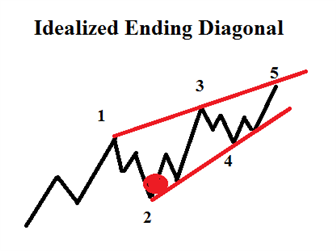

-Higher probability pattern is a bullish ending diagonal

-Anticipating a bullish zigzag for wave 3 of the diagonal to break above 1.1961

-We favor a bullish bias while EUR/USD remains above 1.1718

EUR/USD is bouncing higher off the 2017 trend line. Earlier in the week in the US Opening Bell webinar, we discussed the potential for a diagonal pattern and that EUR/USD would need to hold above the blue trend line to keep it as the favored pattern.

Struggling to trade EUR/USD? This could be why.

If this diagonal pattern holds, we think EUR/USD rises in the third wave of the diagonal. If correct, the pattern calls for EUR/USD to break above 1.1961 so long as price is above the December 12 low of 1.1718.

We know from our Elliott Wave diagonal lessons that each of the five waves in a diagonal carve as zigzags. Therefore, we are anticipating this third wave to take the shape of a bullish zigzag. One of Elliott’s rules is that a third wave must make progress over the first wave. Therefore, we are anticipating a break higher above 1.1961.

The blue trend line can be an early warning signal that some other pattern may be at play. Though the pattern is valid above 1.1718, a move back below the trend line (near 1.1760) warns of continued losses.

EURUSD Sentiment Favors Bulls

The EURUSD sentiment picture is painted with bulls in mind. Traders have accumulated their short positions with the live trader sentiment reading currently -2.1. This is a bullish signal as sentiment is a contrarian indicator.

Bottom line, the shorter term patterns and sentiment analysis point towards higher levels. Risk on the trade can be set near 1.1718.

Are you new to trading the FX market? This guide was created just for you.

Want to learn more about Elliott Wave analysis? Grab the Beginner and Advanced Elliott Wave guides and keep them near your computer.

EURUSD Diagonal Pattern

---Written by Jeremy Wagner, CEWA-M

Jeremy is a Certified Elliott Wave analyst with a Master’s designation. This report is intended to help break down the patterns according to Elliott Wave theory.

See Jeremy’s other forecasts:

NZDUSD – Fourth Wave Close to Terminating

Follow on twitter @JWagnerFXTrader .

Join Jeremy’s distribution list.