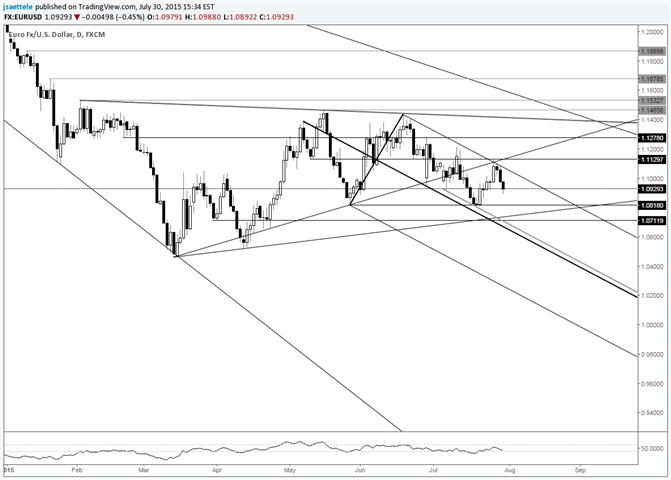

Daily

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader and see ideas on other USD crosses

-“EURUSD has broken support from the slope that extends off of the March and May lows. Near term focus is on the line that extends off of the March and April lows. That line is close to the 3/31 low over the next several days. Many are wondering whether or not this is the beginning of the next bear leg in EURUSD. It could be but a larger drawn out range is also a possibility.”

-“If EURUSD is headed lower near term (next few weeks), then it needs to turn down now (confluence of old support and ‘new’ resistance).” EURUSD turned lower so focus is on the line that extends off of the March and April lows (mid-1.0700s).

For more analysis and trade setups (exact entry and exit), visit SB Trade Desk