Dow Jones, S&P 500, Wall Street, Technical Analysis, Retail Trader Positioning - Talking Points

- Retail traders are increasing upside exposure on Wall Street

- Is this a warning that the Dow Jones and S&P 500 may fall?

- Check out this week’s webinar recording for further analysis

The Dow Jones and S&P 500 have been aiming lower in recent weeks, falling in-line with losses since topping at the end of last year. Recent losses have been increasingly associated with retrial traders increasing their upside exposure on Wall Street. This can be measured by using IG Client Sentiment (IGCS), which often acts as a contrarian indicator. If this trend in positioning continues, could further pain be in store for risk appetite?

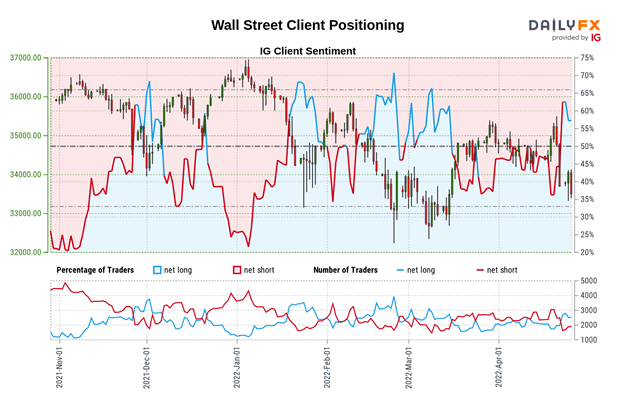

Dow Jones Sentiment Outlook - Bearish

The IGCS gauge shows that about 63% of retail traders are net-long the Dow Jones. Since the majority of traders are biased to the upside, this suggests that prices may continue falling. This is as long exposure increased by 2.63% and 66.49% compared to yesterday and last week respectively. With that in mind, these combinations are offering a stronger bearish contrarian trading bias.

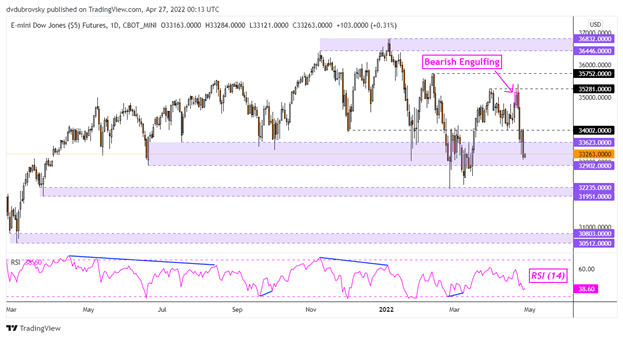

Dow Jones Daily Chart

Dow Jones futures have extended losses over the past few trading sessions, bringing prices back into the 32902 – 33623 support zone after rejecting 35281 resistance. This also followed a Bearish Engulfing candlestick pattern. A breakout under the zone would subsequently place the focus on March 2021 lows, making for a range of support between 31951 and 32235.

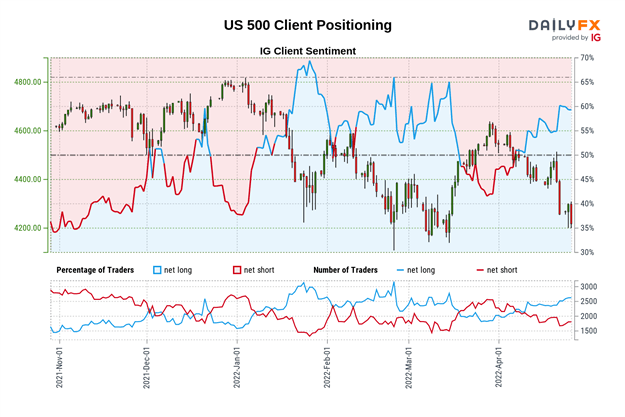

S&P 500 Sentiment Outlook - Bearish

The IGCS gauge shows that roughly 62% of retail traders are net-long the S&P 500. Since a majority are biased to the upside, this suggests that prices may continue falling. This is as upside exposure increased by 2.06% and 22.68% compared to yesterday and last week respectively. With that in mind, these signals are offering a stronger bearish contrarian trading bias.

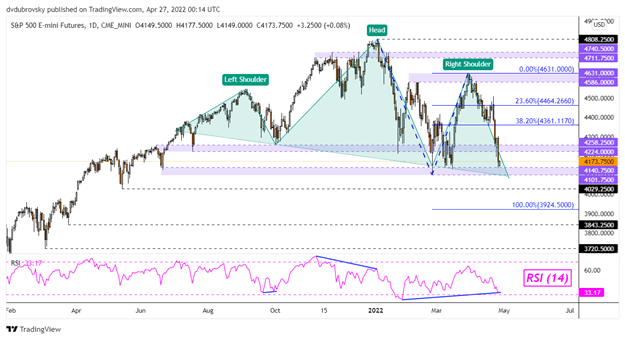

S&P 500 Daily Chart

S&P 500 futures could be in the process of carving out a bearish Head and Shoulders chart formation. Prices are now pressuring the neckline and 4101 – 4140 support zone. A breakout lower could open the door to extending losses towards the May 2021 low at 4029. Beyond that is the 100% Fibonacci extension at 3924. Otherwise, immediate resistance could be the 4224 – 4258 inflection zone.

*IG Client Sentiment Charts and Positioning Data Used from April 26th Report

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter