S&P 500, Dow Jones, Technical Analysis, Retail Trader Positioning - Talking Points

- Retail Traders continue to increase short bets on Wall Street

- Will S&P 500 and Dow Jones extend recent gains as a result?

- Keep a close eye on key near-term trendlines for resistance

Looking at IG Client Sentiment (IGCS), retail traders recently increased bets that equities on Wall Street may decline ahead. Downside exposure is rising in the S&P 500 and Dow Jones. At times, IGCS can function as a contrarian indicator. If this trend in positioning continues, then the overall market may continue recovering from the volatility seen in January.

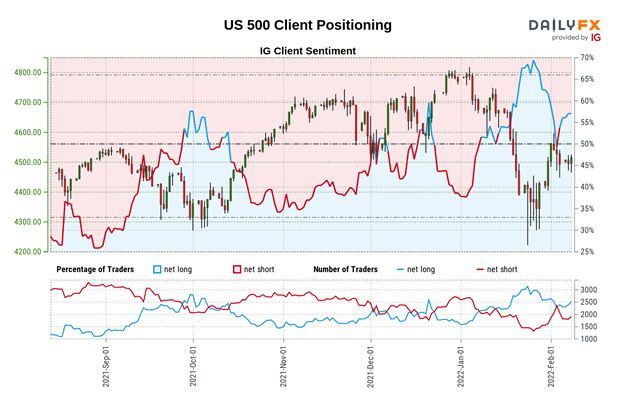

S&P 500 Sentiment Outlook - Bullish

The IGCS gauge shows that about 55% of retail traders are net-long the S&P 500. Since most traders are biased higher, this hints prices may continue falling. However, downside exposure has increased by 7.89% and 5.65% compared yesterday and last week respectively. The combination of current and recent changes in positioning is producing a bullish contrarian trading bias.

S&P 500 Futures 4-Hour Chart

On the 4-hour chart, S&P 500 futures continue to trade under a near-term falling trendline from the beginning of this year. A bullish Golden Cross between the 20- and 50-period Simple Moving Averages (SMAs) remains in play, offering an upside technical bias. Clearing the trendline exposes the 61.8% Fibonacci retracement level at 4580 before targeting the 78.6% level at 4680. Downtrend resumption entails a close under the 4212 – 4266 support zone.

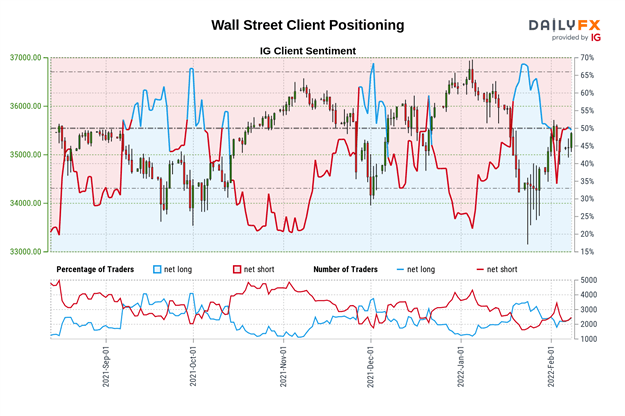

Dow Jones Sentiment Outlook - Bullish

The IGCS gauge reveals that about 42% of retail traders are net-long the Dow Jones. Since most traders are biased to the downside, this suggests prices may keep rising. This is as downside exposure increased by 28.75% and 16.09% compared to yesterday and last week respectively. The combination of current and recent changes in positioning are offering a bullish contrarian trading bias.

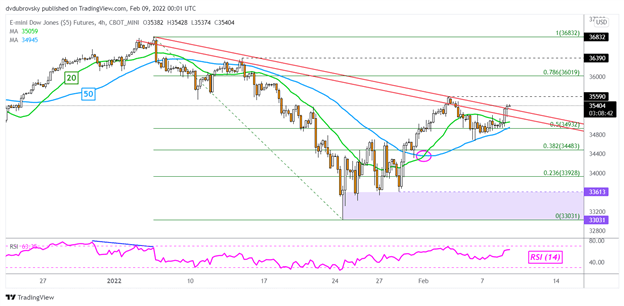

Dow Jones Futures 4-Hour Chart

On the 4-hour chart, Dow Jones futures are attempting to breach a near-term descending trendline from the beginning of this year. A confirmatory close above the early February high at 35590 may hint at uptrend resumption. That would expose the January 13th peak at 36390 before this year’s high at 36832 comes into focus. Downtrend resumption entails a break under the 33031 – 33613 support zone.

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Daniel Dubrovsky

*IG Client Sentiment Charts and Positioning Data Used from February 8th Report

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter