US Dollar, USD/SGD, USD/THB, USD/PHP, USD/IDR – ASEAN Technical Analysis

- US Dollar steadied against ASEAN currencies this past week

- USD/SGD remains consolidating, USD/THB eyeing cup handle

- USD/IDR may rise with trendline, USD/PHP idling at support

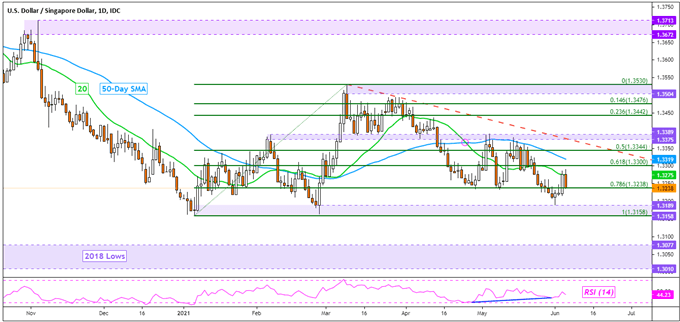

Singapore Dollar Technical Outlook

The US Dollar pushed higher against the Singapore Dollar this past week, but USD/SGD was not able to make it far before the 20-day Simple Moving Average stepped in as key resistance. A bearish ‘Death Cross’ with the 50-day SMA occurred back in April, signaling the potential for further losses. Still, the key 1.3158 – 1.3189 support zone remains in play. The pair needs to take that zone out for a shot at resuming the dominant downtrend. Otherwise, further gains may place the focus on falling resistance from March.

USD/SGD Daily Chart

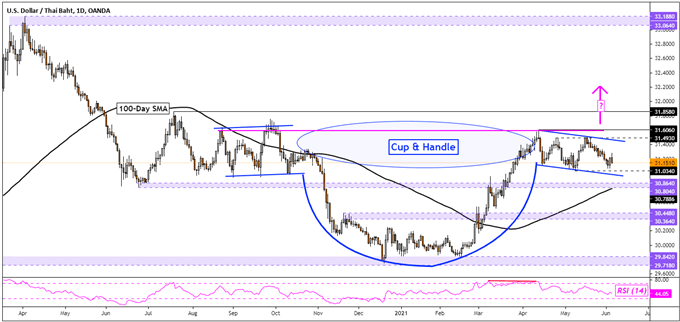

Thai Baht Technical Outlook

The Thai Baht may still be brewing a bullish Cup and Handle chart pattern against the US Dollar. USD/THB remains in a near-term downtrend since April, which makes up the handle of the formation. As such, the pair may continue consolidating with a slight downward bias. Traders ought to keep a close eye out for a test of the ceiling of the handle, a breakout higher could open the door to extending gains from March. Otherwise, taking out support at 31.0340 may place the focus on the 100-day SMA.

USD/THB Daily Chart

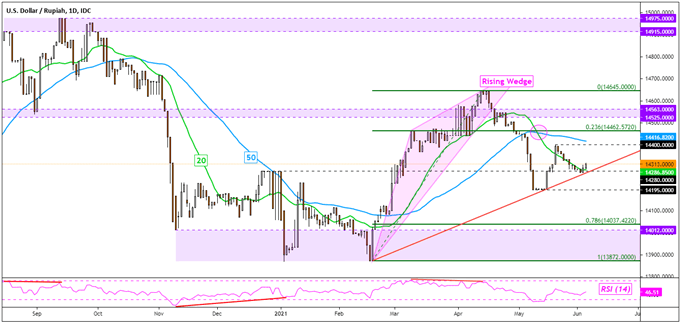

Indonesian Rupiah Technical Outlook

The US Dollar may pivot higher against the Indonesian Rupiah after USD/IDR established a rising trendline from February – see chart below. Still, the downward signals of a bearish Rising Wedge and ‘Death Cross’ underline a near-term downside bias. Immediate resistance seems to be at 14400, or the May 20th high. A breakout above could open the door to resuming the early May bounce. Otherwise, dropping under the trendline may open the door to revisiting 14195.

For updates on ASEAN currencies as they break key technical levels, be sure to follow me on Twitter @ddubrovskyFX.

USD/IDR Daily Chart

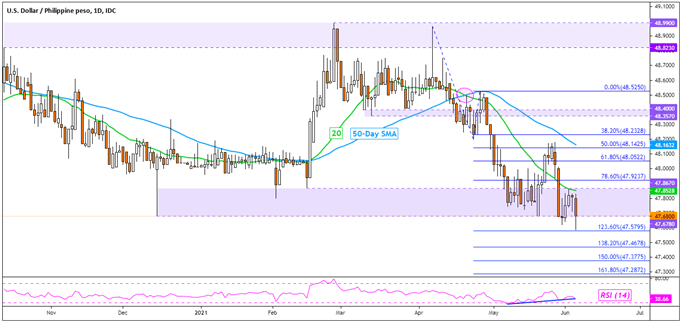

Philippine Peso Technical Outlook

The Philippine Peso continues to struggle at making further gains against the US Dollar. The key 47.6780 – 47.8670 support zone remains in play. This is as positive RSI divergence warns that downside momentum is fading. This can at times precede a turn higher. Such an outcome may place the focus on the 20-day SMA, followed by the 50 if the former is taken out. Otherwise, downtrend resumption has the 123.60% Fibonacci extension in focus at 47.5795. Under that is the 138.20% level at 47.4678.

USD/PHP Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter