Bitcoin (BTC/USD), Ethereum (ETH/USD),Litecoin (LTC/USD), Technical Analysis – Talking Points

- Marketwide volatility hit cryptocurrencies on worst day since early 2020

- Bitcoin could be vulnerable after prices took out the key 200-day SMA

- Ethereum eyeing 100-day SMA, Litecoin took out medium-term trendline

Bitcoin Technical Outlook

Bitcoin suffered its worst daily drop in over 14 months on Wednesday. Weakness wasn’t just isolated to BTC, but felt throughout digital currencies in one amplified move. This was a pronounced marketwide reaction that wiped out about US$1 trillion from the total crypto market cap. So where does this leave Bitcoin, Ethereum and Litecoin from a technical perspective? What could traders expect in the event of deeper losses?

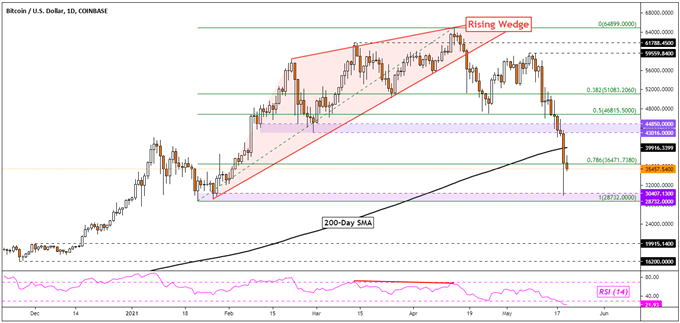

BTC/USD completed the downside target implied from a bearish Rising Wedge chart pattern. This is something that I warned about in late April. However, prices swiftly bounced off the key 28732 – 30407 support zone as the cryptocurrency struggled to confirm a drop through the 30k handle. Dip buyers stepped in, trimming a decent chunk of losses.

Still, all eyes are now on the 200-day Simple Moving Average (SMA). It seems that Bitcoin has taken it out. A subsequent downside close after could paint a still-vulnerable road ahead for the cryptocurrency. Such an outcome would likely place the focus back on January lows. In the event of a turn higher, a push above the 43016 – 44850 inflection zone could open the door to more gains.

BTC/USD - Daily Chart

Ethereum Technical Outlook

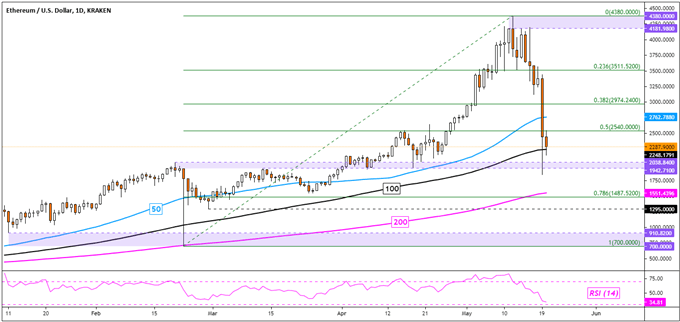

Ethereum also suffered its worst daily performance in over 14 months. The drop through the 38.2% level and midpoint of the Fibonacci retracement at 2974 and 2540 respectively took out the 50-day SMA. ETH/USD briefly dropped under the 100-day SMA, but dip buyers restored some upward momentum. A push back above the 50-day line could open the door to reversing the near-term downtrend. Otherwise, the 2038 – 1942 inflection zone could come into focus as key support. Dropping through it exposes lows from February and March, as well as the 200-day SMA.

ETH/USD - Daily Chart

Litecoin Technical Outlook

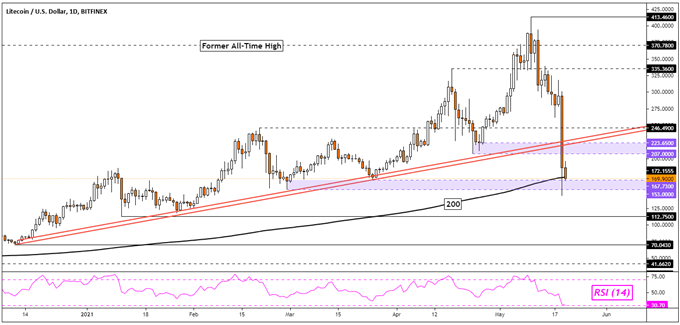

Litecoin may be at risk to extending losses after LTC/USD closed under rising support from late 2020. The cryptocurrency also took out the 223 – 207 support zone, failing to overcome the 153 – 167 range thereafter as prices left behind a large shadow. That is where the 200-day SMA came in to maintain the dominant focus to the upside. A push higher from here could place the focus on rising support, which could act as new resistance. Otherwise, extending losses exposes the January low at 112.

LTC/USD - Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter