US Dollar, USD/SGD, USD/MYR, USD/IDR, USD/PHP – ASEAN Technical Analysis

- US Dollar uptrend at risk against ASEAN FX on fiscal stimulus bets

- Technical signals show USD/SGD, USD/MYR and USD/IDR may fall

- USD/PHP drops back into congestive range. All eyes on key US data

Singapore Dollar, Malaysian Ringgit, Indonesian Rupiah, Philippine Peso Technical Outlook

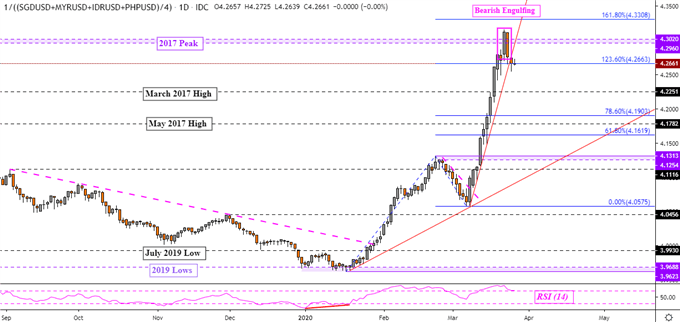

The US Dollar may be at risk as bearish technical signals hint that the Greenback could turn lower against some of its ASEAN counterparts. On the daily chart below is my ASEAN-based USD index which averages it against SGD, MYR, IDR and PHP. A Bearish Engulfing formed as prices struggled to push through peaks from 2017. Further downside confirmation may spell a turn in what have been aggressive gains of late.

The US Dollar weakened as markets priced in aggressive fiscal stimulus from the world’s largest economy amid the coronavirus outbreak. This increasingly reduces the scope of surprise when the bill is signed into law. From that point, the markets will weigh stimulus against what is expected to be dismal local data ahead. The fluid situation of the virus and social isolation measures make finding follow-through in markets key.

ASEAN-Based US Dollar Index – Daily Chart

ASEAN Chart Created in TradingView

Singapore Dollar Technical Outlook

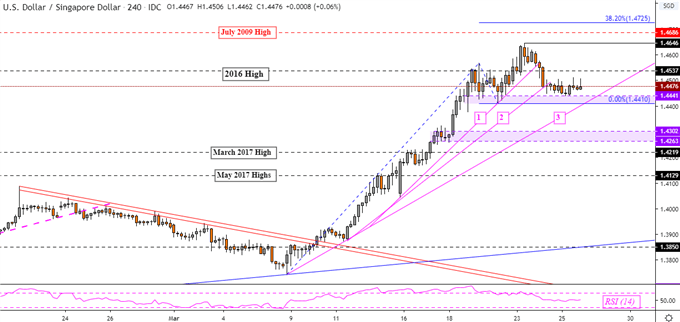

The Singapore Dollar has cleared through rising support “1” and “2” on the 4-hour chart below. That has left USD/SGD facing support “3” after Singapore GDP shrank by the most in over a decade. The latter is still maintaining the dominant upside bias. Closing under key support – a range between 1.4410 to 1.4441 – may place gains at risk. That would expose immediate support which is a range from 1.4263 to 1.4302. Resuming the uptrend entails closing above 1.4646 towards the July 2009 high.

Learn more about how the MAS conducts monetary policy and what matters for the Singapore Dollar !

USD/SGD 4-Hour Chart

USD/SGD Chart Created in TradingView

Malaysian Ringgit Technical Outlook

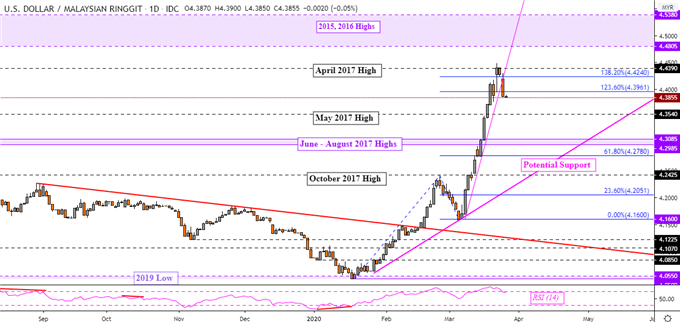

The Malaysian Ringgit may also be setting up for a recovery against the US Dollar. On the daily chart, USD/MYR has closed under rising support from earlier this month. A further downside close could potentially send the pair towards the June to August 2017 inflection point. Down the road, “potential support” from January could reinstate an upward trajectory. Resuming gains entails pushing through recent peaks around the April 2017 high at 4.4390.

USD/MYR Daily Chart

USD/MYR Chart Created in TradingView

Indonesian Rupiah Technical Outlook

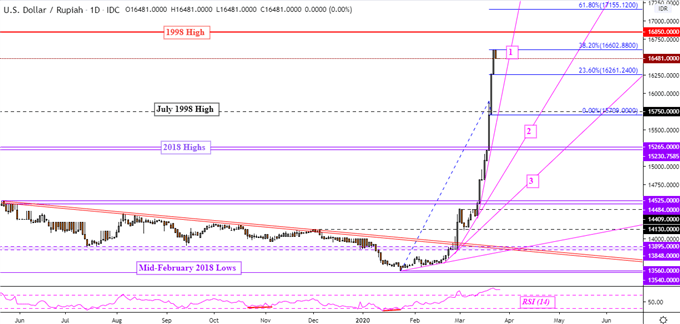

The US Dollar paused its aggressive rise against the Indonesian Rupiah after USD/IDR turned lower on the 38.2% Fibonacci extension at 16602. A descent through support “1” exposes layer “2” which may down the road maintain the upward trajectory. For the time being, prices trade around levels that have not been seen since the aftermath of the 1997 Asia financial crisis. Resuming the uptrend may lead to a test of the 1998 peak.

USD/IDR Daily Chart

USD/IDR Chart Created in TradingView

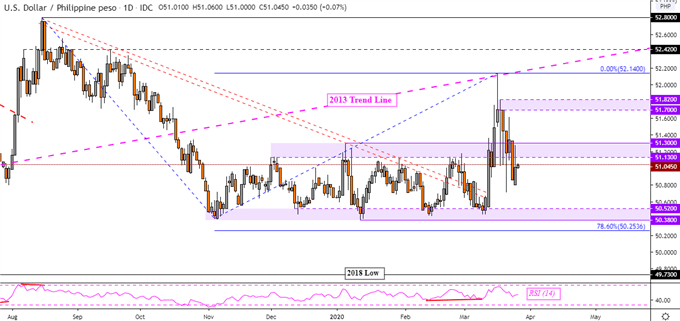

Philippine Peso Technical Outlook

The Philippine Peso has returned to its former consolidative range against the US Dollar after a false upside breakout. If prices struggle to push through resistance (51.13 – 51.30), there may be a turn lower in USD/PHP towards the floor at 50.38 – 50.52. Otherwise, climbing through resistance could pave the way for a retest of the next upper range between 51.70 to 51.82.

To stay updated on fundamental developments for ASEAN currencies, follow me on Twitter here @ddubrovskyFX

USD/PHP Daily Chart

USD/PHP Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter