USD/MXN Highlights:

- USD/MXN continues to soar as EMs quickly devalue against USD

- A pullback looks near, but shorting doesn’t hold a lot of appeal

USD/MXN continues to soar as EMs quickly devalue against USD

The Mexican Peso and other emerging market currencies have been coming under extreme pressure as the Dollar continued to squeeze at a nearly unprecedented pace. In roughly a month USD/MXN has soared over 30%. Moves like this are rarely ever seen, which is why despite it looking a little rich, faders will want to be careful.

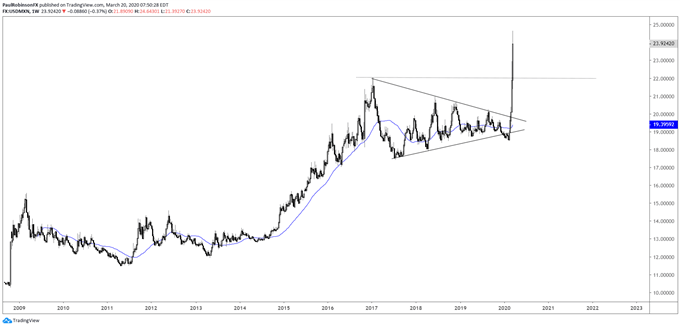

We have crossed a sort of Rubicon, and that means things could get nuttier before easing. With that in mind, we may still be near a meaningful decline in terms of time, but the last part of the run could be the most extreme given the current environment.

How high a further squeeze could go is anyone’s guess. How far a decline could be as well is also difficult to gauge. If you want a model of sorts of what kind of wild gyrations could result soon, take a look at EUR/NZD, as it had an incredible 10% range yesterday. USD/MXN could go even bigger given it is trading at stock market type volatility.

How to do you trade this thing, then? If one is trading it, trading small is prudent, that is first and foremost. Secondly, be disciplined in sticking to risk parameters (i.e. stops). For others, maybe standing aside until it calms down a bit will be the way to go.

USD/MXN Daily Chart (could spike some more, but pullback risk also high)

USD/MXN Weekly Chart (hard to say where it ends)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX