USD/MXN Highlights:

- USD/MXN wiped out Friday/Monday gains in one fell swoop

- Expect volatility to remain heightened in the near-term

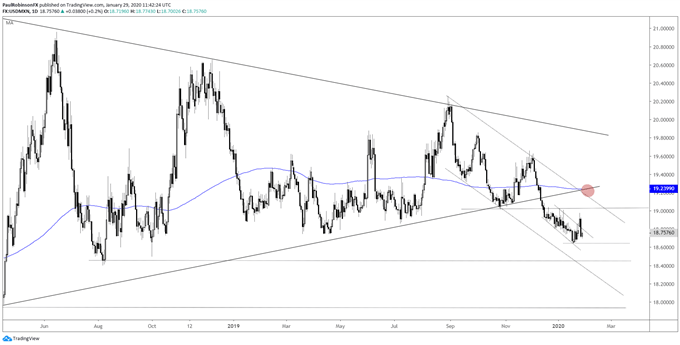

- Long-term triangle breakout remains in effect

USD/MXN wiped out Friday/Monday gains in one fell swoop

It was just Friday morning before stocks took a sizable hit that I was discussing the potential for a rally in the Dollar versus the Peso on a risk-off event. Indeed, on Friday and Monday as the market shunned higher-yielding assets there was a bid in USD/MXN that led to modestly higher prices. However, yesterday, when risk rebounded the Peso rallied just as impressively, wiping out the two-day gains.

The one-day hit was a big blow to the small channel breakout, and with downside momentum having been so strong yesterday I am inclined to look for more weakness to come. But it is likely that until the markets are on firmer footing (i.e. coronavirus situation materially improves) volatility will persist in the near-term.

A decline through 18.64 helps clear a path for a test of the August 2018 low around 18.40. A down-move to that point would further along the broader triangle breakout we saw in the first half of last month. The triangle dating back to 2017 suggests that USD/MXN is set to make a big move, and so far the direction is to the downside.

But this doesn’t mean there isn’t potential for the breakdown to turn out to be false. Oftentimes a break from a triangle against the primary trend, which is up in this case (has been for many, many years), can turn out to be a false one before price reverses course back in the direction of the prevailing trend.

For now, though, we must still respect the fact that the breakout has been bearish, and keep in mind that if USD/MXN accelerates higher it might turn out to be the direction it wants to go more broadly speaking. It will take a rally back inside the triangle (>19.35) to strengthen the reversal scenario.

USD/MXN Daily Chart (wiped out gains, watching 18.64)

USD/MXN Weekly Chart (outside of triangle against primary trend)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX