USD/SGD, USD/MYR, USD/IDR, USD/PHP - Talking Points

- US Dollar attempting key technical pushes against ASEAN FX

- USD/SGD, USD/MYR and USD/IDR could extend their gains

- USD/PHP trading cautiously higher, confining to rising channel

Trade all the major global economic data live as it populates in the economic calendar and follow live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

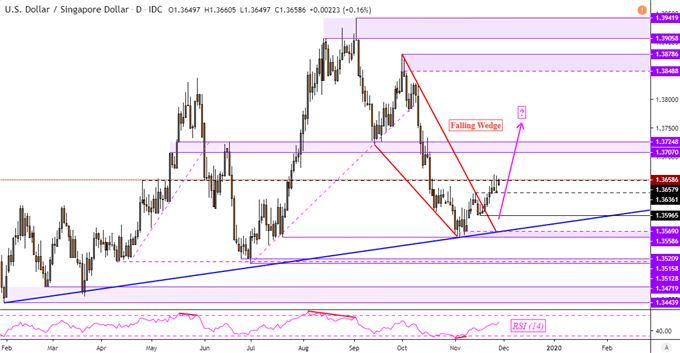

USD/SGD Technical Outlook

The Singapore Dollar may weaken against the US Dollar after USD/SGD confirmed an upside breakout through the Falling Wedge. This is a bullish chart pattern the could precede a reversal of the dominant downtrend. A daily close above 1.3657 opens the door to testing the next psychological barrier (1.3707 – 1.3724). Progress in US-China trade talks on the other hand could offer downside momentum towards 1.3596.

Learn more about how the MAS conducts monetary policy and what matters for the Singapore Dollar !

USD/SGD Daily Chart

USD/SGD Chart Created in TradingView

USD/MYR Technical Outlook

This is as the US Dollar is attempting to break above key descending resistance against the Malaysian Ringgit. The near-term USD/MYR uptrend still holds after Wednesday’s pullback after prices paused their drop on the channel – pink lines below. Continued momentum from bulls may translate into another test of 4.1850 before eyeing October highs. A daily close under 4.1630 may overturn this bullish signal.

To stay updated on fundamental developments for ASEAN currencies, follow me on Twitter here @ddubrovskyFX

USD/MYR Daily Chart

USD/IDR Technical Outlook

USD/IDR is also facing a similar technical scenario with the Indonesian Rupiah sitting on the edge of the falling trend line from May. A daily close through resistance (14092 – 14115) opens the door to overturning the dominant downtrend as price eye October highs. A turn lower on the other hand places the focus on near-term support at 14035 followed by 14000.

USD/IDR Daily Chart

USD/IDR Chart Created in TradingView

USD/PHP Technical Outlook

The Philippine Peso continues to trade in a rising channel against the US Dollar – red area on the chart below. USD/PHP recently bounced on the floor, perhaps paving the way for a retest of near-term resistance at 51.02. Further upside progress would also be in-line with the break above descending resistance from September (pink lines). Resuming the downtrend entails taking out 50.40 – current November lows.

USD/PHP Daily Chart

USD/PHP Chart Created in TradingView

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter