Brexit Latest News:

- Amid signs that UK Prime Minister Boris Johnson is on the path to win re-election, the British Pound has been able to retain its recent gains.

- The TV debate last night produced a favorable result for UK PM Johnson, winning 51% to 49% against Labour Party leader Jeremy Corbyn, according to YouGov.

- Retail trader positioning continues to point to a mixed trading outlook for the British Pound.

Looking for longer-term forecasts on the British Pound? Check out the DailyFX Trading Guides.

British Pound Sustains Gains After TV Debate

Financial markets’ collective attention has turned back to Brexit over the past 24-hours following the TV debate between the Tory Leader and Labour Party leaders. The TV debate last night produced a favorable result for UK PM Johnson, winning 51% to 49% against Labour Party leader Jeremy Corbyn, according to YouGov.

Amid signs that UK Prime Minister Boris Johnson is on the path to win re-election, the British Pound has been able to retain its recent gains. Last week, news broke that Brexit Party leader Nigel Farage announced that he would not challenge UK PM Johnson.

Markets are still acting as if Brexit will proceed under the plan agreed to in October. An outcome that reduces uncertainty around Brexit – continuation of governance by UK PM Johnson and the Tory Party – is still seen as a positive development for the British Pound.

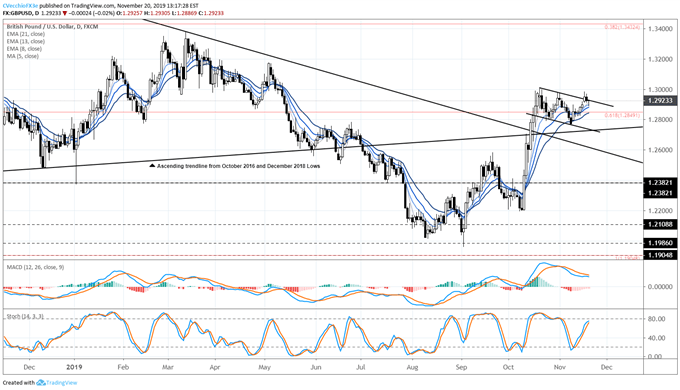

GBP/USD Rate Technical Analysis: Daily Chart (NOVEMBER 2018 to NOVEMBER 2019) (Chart 1)

In our last GBP/USD rate forecast technical analysis update, it was noted that the “traders may want to look for outcomes yielding a strong British Pound.” Since then, the bull flag that has formed now sees GBP/USD breaking above resistance from the October and November swing highs, all while continuing to hold above the descending trendline from the April 2018 and March 2019 highs.

Momentum in GBP/USD has softened in recent days but remains mostly bullish. GBP/USD is still above the daily5, 8-, 13-, and 21-EMA envelope. Daily MACD’s move lower in bullish territory is slowing, and Slow Stochastics are racing higher towards overbought territory.

It thus still holds that as long as "GBP/USD continues to hold above the descending trendline from the April 2018 and March 2019 highs broken, as well as the 61.8% retracement of the ‘post-Brexit vote trading range’ – the October 2016 low to the April 2018 high – at 1.2849. More gains may be ahead.”

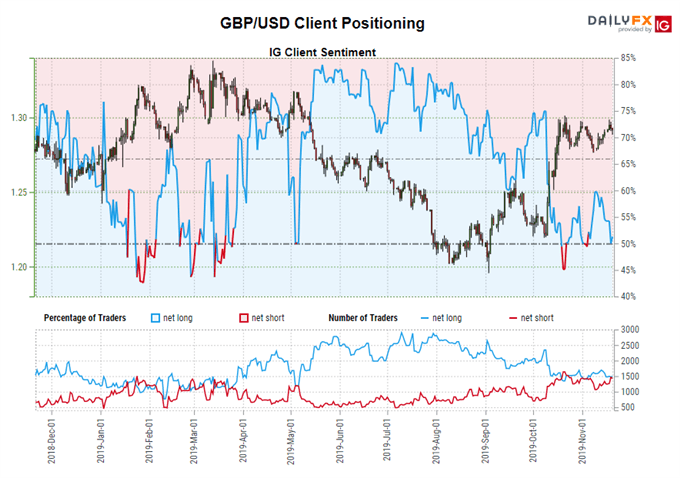

IG Client Sentiment Index: GBP/USD Rate Forecast (NOVEMBER 20, 2019) (Chart 2)

GBP/USD: Retail trader data shows 51.94% of traders are net-long with the ratio of traders long to short at 1.08 to 1. The number of traders net-long is 1.12% higher than yesterday and 12.46% lower from last week, while the number of traders net-short is 6.20% lower than yesterday and 12.14% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

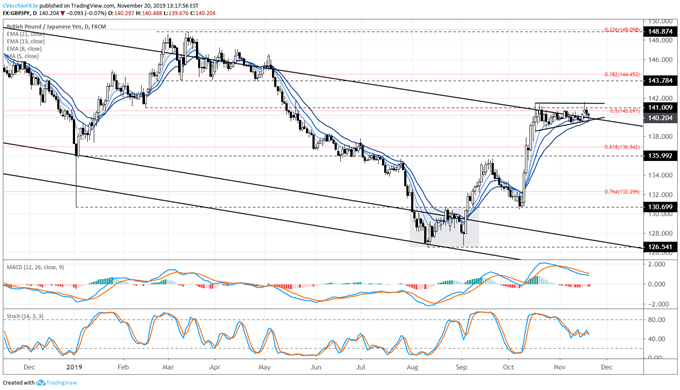

GBP/JPY Technical Analysis: Daily Rate Chart (NOVEMBER 2018 to NOVEMBER 2019) (Chart 3)

The consolidation in GBP/JPY rates in recent weeks has morphed from a symmetrical triangle into an ascending triangle; in context of the move higher in October, both consolidations favor topside resolution.

As such, the GBP/JPY sideways consolidation in place since the October 17 high/low between 138.62 and 141.51 remains in place, despite a brief attempt to climb out of the consolidation earlier this week.

GBP/JPY continues to hold below the descending trendline resistance (dating back to the January 2018 high) as well as the 50% retracement of the 2016 to 2018 low/high range at 140.70. The October 17 low at 138.62 has not been tested yet.

GBP/JPY has recovered above the daily5-, 8-, 13-, and 21-EMA envelope. Yet daily MACD has continued its downtrend over the course of November (although it remains in bullish territory) and Slow Stochastics are oscillating around the neutral line.

It still holds that a bullish breakout is not out of the question above 141.51, although traders should be open to more downside if GBP/JPY loses 138.62.

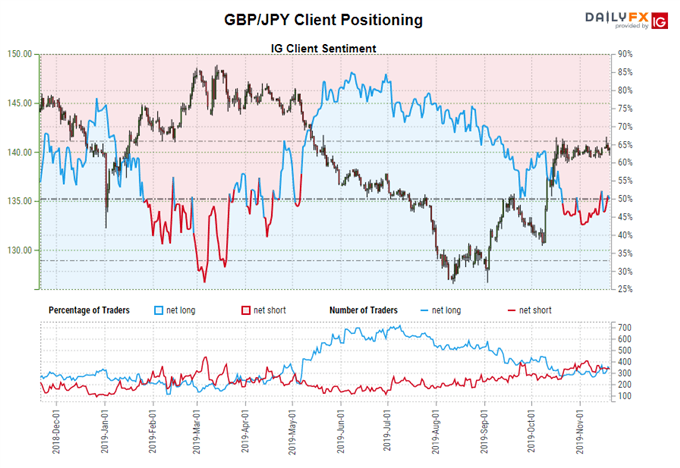

IG Client Sentiment Index: GBP/JPY Rate Forecast (NOVEMBER 202019) (Chart 4)

GBP/JPY: Retail trader data shows 50.39% of traders are net-long with the ratio of traders long to short at 1.02 to 1. The number of traders net-long is 14.78% lower than yesterday and 2.54% higher from last week, while the number of traders net-short is 8.36% lower than yesterday and 18.04% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/JPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/JPY trading bias.

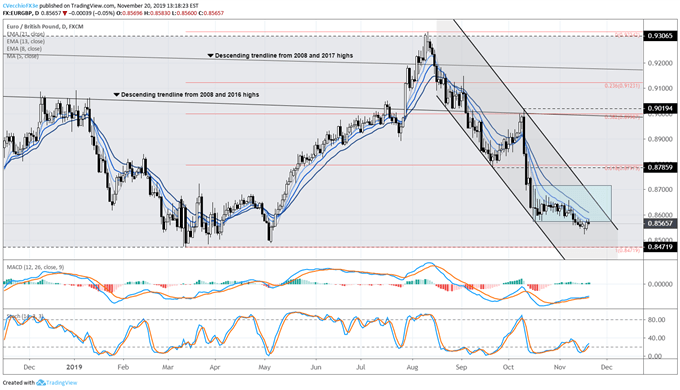

EUR/GBP Technical Analysis: Daily Rate Chart (NOVEMBER 2018 to NOVEMBER 2019) (Chart 5)

Not much has changed for EUR/GBP rates over the past week. EUR/GBP rates remain below the October 16 doji candle low at 0.8597. EUR/GBP rates are still below the daily 5-, 8-, 13-, and 21-EMA envelope. Yet the lack of progress over the past week has seen Slow Stochastics continue to rise back towards the neutral line, while Slow Stochastics has started to rebound out of oversold territory. With EUR/GBP trading at 0.8561, the conditions for a bearish breakdown are in place – but maybe not for much longer.

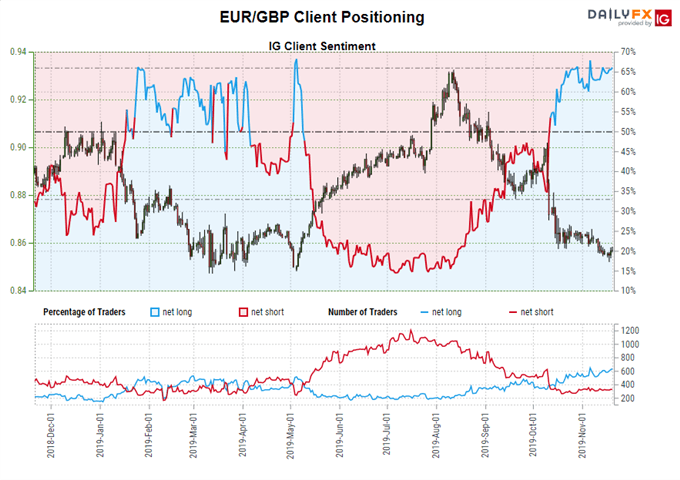

IG Client Sentiment Index: EUR/GBP Rate Forecast (NOVEMBER 20, 2019) (Chart 6)

EUR/GBP: Retail trader data shows 66.05% of traders are net-long with the ratio of traders long to short at 1.95 to 1. The number of traders net-long is 0.62% lower than yesterday and 8.94% higher from last week, while the number of traders net-short is 3.49% lower than yesterday and 1.19% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides