Brexit Latest Developments:

- News reports indicate that the EU is willing to reassess the Northern Ireland border issue, giving space for GBP-crosses to reverse their losses from earlier on the session.

- If UK PM Johnson’s desire to get take the UK out of the EU on October 31 truly is an effort of ‘come hell or highwater,’ then it’s still possible that he circumvents UK parliament.

- Retail trader positioning suggests that the GBP-crosses are on uneven footing, although there’s not much directional agreement.

Looking for longer-term forecasts on the British Pound? Check out the DailyFX Trading Guides.

Developments on the Brexit front have produced another wave of volatility for British Pound rates. With news reports indicating that the EU is willing to reassess the Northern Ireland border issue, GBP-crosses have been able to reverse their losses from earlier on the session.

Reports indicate that the time light proposal would only be offered if the UK accepted an Irish-only backstop. Concerns persist that a hard border between Northern Ireland and Ireland could upend the regional stability since the 1998 Good Friday Agreement. The EU’s proposal would see Northern Ireland remain in the customs union with the EU, while England, Scotland and Wales – would Brexit.

Volatility should remain elevated among the GBP-crosses over the coming days as UK Prime Minister Boris Johnson is set to release his government’s Brexit plan this coming Thursday.

Upcoming Key Brexit Dates

There is a last minute EU-UK summit scheduled for October 17 to 18 in order to try and hammer out the details for the October 31 Brexit deadline. Thanks to the passage of the Benn Act at the start of September, UK parliament now has a procedure in place to prevent UK PM Johnson from forcing through a no-deal, hard Brexit: if UK PM Johnson can’t find consensus with his EU counterparts, then he will be compelled to seek another Brexit deadline extension.

If UK PM Johnson’s desire to get take the UK out of the EU on October 31 truly is an effort of ‘come hell or highwater,’ then it’s still possible that he circumvents UK parliament. Some of speculated that an “order of council” could be used, a decree passed by ministers without the involvement of the Queen or UK parliament. Others have noted that UK PM Johnson could declare a national emergency under the 2004 “Civil Contingencies Act” in order to sidestep the Benn Act or call a general election.

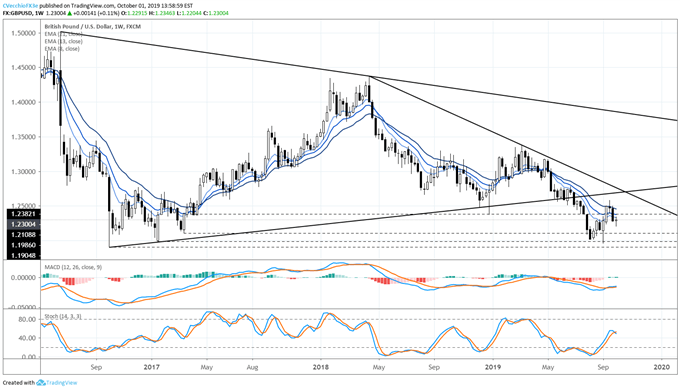

GBPUSD RATE TECHNICAL ANALYSIS: WEEKLY CHART (JUNE 2016 TO October 2019) (CHART 1)

Last week’s bearish piercing candle helped establish a three-candle bearish evening star candle cluster, a topping pattern. This week so far, a doji candle has been forming. GBPUSD rates are now below the descending trendline from the May and June 2019 highs, and continue to hold below the weekly 8-, 13-, and 21-EMA envelope (which remains in bearish sequential order). Weekly MACD has started to turn lower in bearish territory, while Slow Stochastics have issued a sell signal in bullish territory slow. The longer-term technical perspective remains concerning.

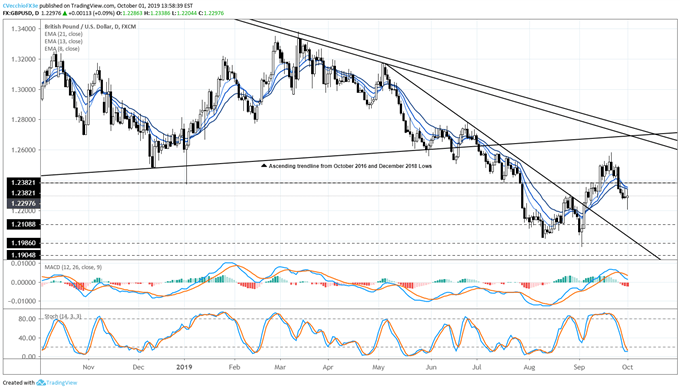

GBPUSD Rate Technical Analysis: Daily Chart (October 2018 to October 2019) (Chart 2)

GBPUSD rates are still below the daily 8-, 13-, and 21-EMA envelope (which is now in bearish sequential order). Slow Stochastics have moved into oversold territory, and daily MACD has turned lower (albeit still in bullish territory). GBPUSD rates, unable to hold above 1.2380/85, does not have the technical structure in place to suggest that a low is in place; a move back above this level would suggest that the mood is turning more positive with respect to Brexit.

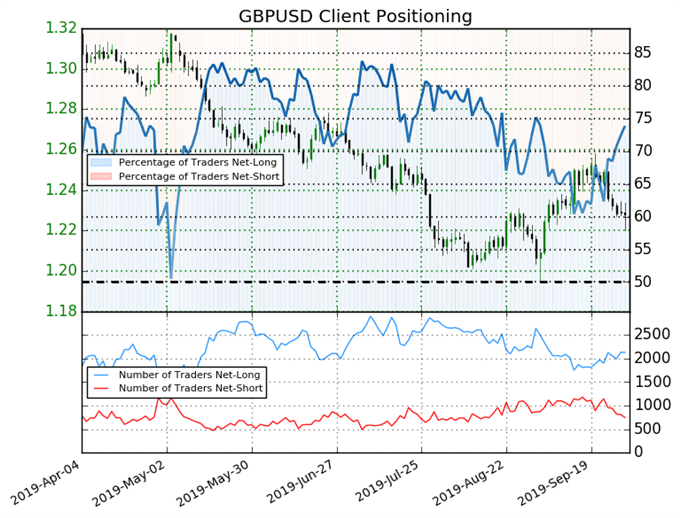

IG Client Sentiment Index: GBPUSD Rate Forecast (October 1, 2019) (Chart 3)

GBPUSD: Retail trader data shows 73.9% of traders are net-long with the ratio of traders long to short at 2.83 to 1. In fact, traders have remained net-long since May 6 when GBPUSD traded near 1.3067 price has moved 6.0% lower since then. The number of traders net-long is 2.4% lower than yesterday and 0.2% lower from last week, while the number of traders net-short is 18.2% lower than yesterday and 32.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

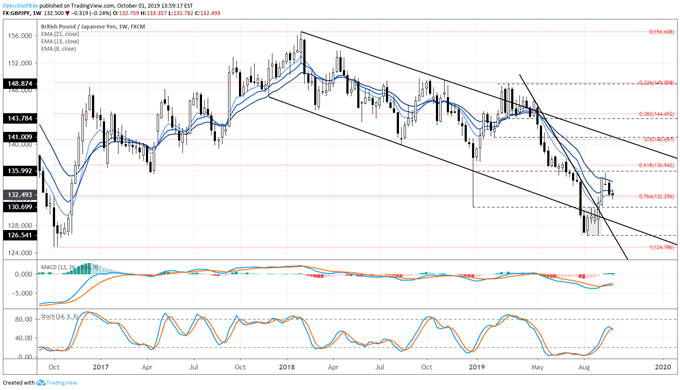

GBPJPY Technical Analysis: Weekly Rate Chart (October 2016 to October 2019) (Chart 4)

Like GBPUSD, last week’s candle for GBPJPY rates were following through on the inverted weekly hammer. The bearish outside piercing candle has seen modest follow through lower, although it appears that a doji candle has taken shape – which speaks to the indecision around the news flow this week. GBPJPY is back below the weekly 8-, 13-, and 21-EMA envelope, which remains in bearish sequential order. Weekly MACD is still pointed higher (albeit in bearish territory), while Slow Stochastics’ have issued a sell signal (albeit in bullish territory).

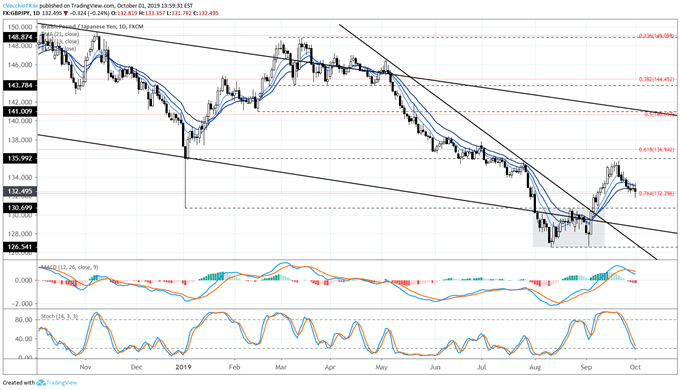

GBPJPY Technical Analysis: Daily Rate Chart (October 2018 to October 2019) (Chart 5)

Nothing material has changed since the last GBPJPY technical forecast update. It still holds that, “the call for a short-term bottoming effort would be invalidated on a return below 130.70. Yet there’s already evidence cropping up that the bottoming effort by GBPJPY rates is failing: a drop below the 76.4% retracement of the 2016 low to 2018 high range at 132.30 would likely trigger the next wave of selling down to 130.70, the bullish outside engulfing bar low on September 9.”

GBPJPY rates are still at the daily 21-EMA; the daily 8-, 13-, and 21-EMA envelope remains in bullish sequential order. Daily MACD has turned lower in bullish territory, while Slow Stochastics have moved into oversold territory.

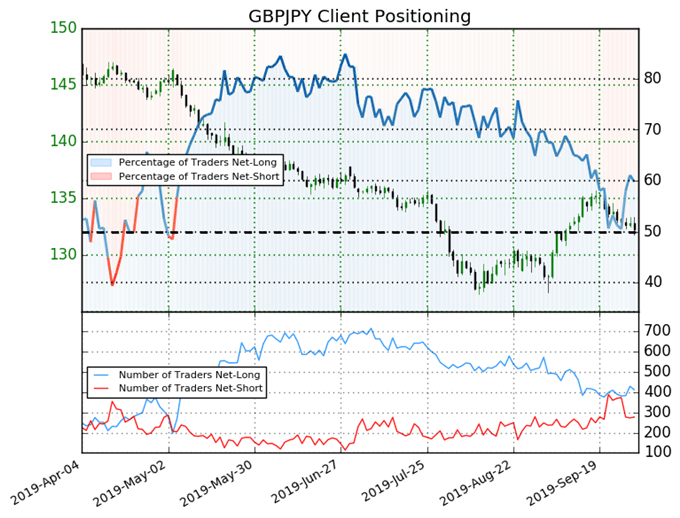

IG Client Sentiment Index: GBPJPY Rate Forecast (October 1, 2019) (Chart 6)

GBPJPY: Retail trader data shows 59.8% of traders are net-long with the ratio of traders long to short at 1.49 to 1. The number of traders net-long is 4.8% lower than yesterday and 2.8% lower from last week, while the number of traders net-short is 3.1% lower than yesterday and 23.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPJPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPJPY trading bias.

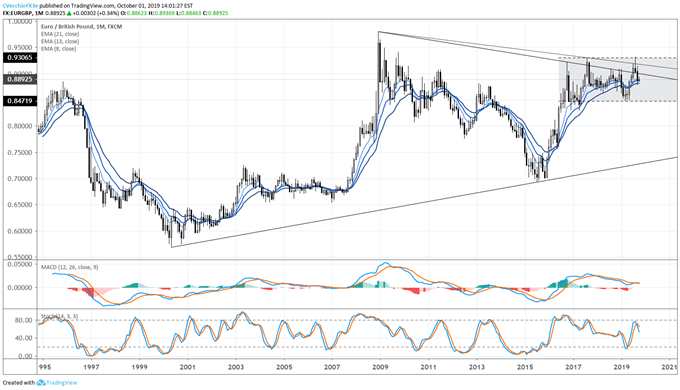

EURGBP Technical Analysis: Monthly Rate Chart (1994 to 2019) (Chart 7)

The monthly timeframe has a new candle now that September has come to a close; yet no progress has been made. EURGBP rates have been trading sideways for nearly three years. The bullish breakout attempt higher through the descending trendlines from the 2008 and 2015 highs and 2008 and 2016 highs failed; the inverted hammer in August saw follow through to the downside in September.

On the monthly timeframe, momentum continues to shift lower. Monthly MACD has issued a sell signal (albeit in bullish territory), while Slow Stochastics have already turned lower (in bullish territory as well). Until the 0.8472 to 0.9307 range breaks – until there is a clear shape of Brexit – traders may find themselves less anxious simply by staying away from EURGBP.

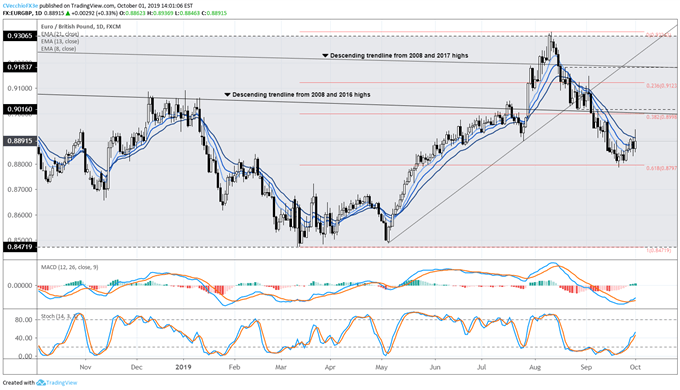

EURGBP Technical Analysis: Daily Rate Chart (October 2018 to October 2019) (Chart 8)

Nothing material has changed since the last EURGBP technical forecast update. It still holds that, “EURGBP rates have rebounded in recent days around the 61.8% retracement of the 2019 low/high range at 0.8797. In turn, the downtrend from the highs in July and August is coming under pressure. EURGBP rates are making their wave above the daily 8-, 13-, and 21-EMA (which is still in bearish sequential order). Daily MACD has turned higher in bearish territory, while Slow Stochastics are rapidly approaching bullish territory. A move through the daily 21-EMA would bring into focus the 38.2% retracement of the 2019 low/high range at 0.8998.”

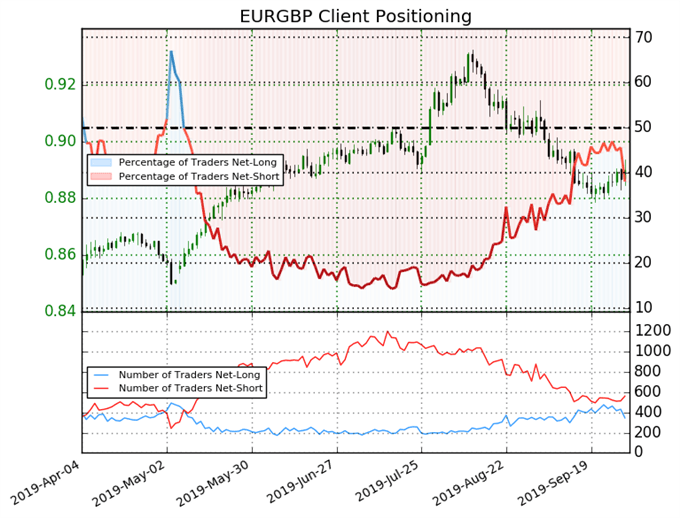

IG Client Sentiment Index: EURGBP Rate Forecast (October 1, 2019) (Chart 9)

EURGBP: Retail trader data shows 38.1% of traders are net-long with the ratio of traders short to long at 1.62 to 1. In fact, traders have remained net-short since May 09 when EURGBP traded near 0.86496; price has moved 2.9% higher since then. The percentage of traders net-long is now its lowest since Sep 11 when EURGBP traded near 0.8928. The number of traders net-long is 22.1% lower than yesterday and 29.1% lower from last week, while the number of traders net-short is 5.0% higher than yesterday and 2.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURGBP prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURGBP-bullish contrarian trading bias.

What Happens to the British Pound: No Deal, Hard Brexit

Under a no-deal, hard Brexit outcome, traders should expect further losses by the British Pound, with EURGBP likely to trade closer to parity (1.0000), GBPJPY could trade towards 120.00, while GBPUSD could fall towards 1.1000 during the first 12-months of a no-deal, hard Brexit (keeping in mind that the European Central Bank and Federal Reserve would likely cut interest rates to prevent Brexit shocks from impacting either the Eurozone or US economies too significantly, thereby capping potential gains by the Euro and the US Dollar versus the British Pound).

What Happens to the British Pound: No Deal, Hard Brexit + Scottish Exit

But this would not be the worst case scenario for the British Pound; in the event that Scotland holds a second independence referendum, it’s likely markets will be facing down the threat of disintegration of Great Britain as we know it. Under a no-deal, hard Brexit coupled with a Scottish vote to leave the UK, traders should expect EURGBP to climb towards 1.0500, GBPJPY to fall towards 112.50, and GBPUSD to drop closer to 1.0500.

What Happens to the British Pound: General Election

There is scope for a short-term recovery for the British Pound if it appears that a no-deal, hard Brexit is delayed. This could come in the form of a general election that replaces Brexit hardliner Boris Johnson as UK prime minister. The vote on Tuesday, September 3 should be watched closely to see if the UK parliament is able to retake control of its schedule and avoid prorogation. In the event of a delay in the Brexit process, EURGBP could fall back towards 0.8600, GBPJPY could trade towards 133.00, while GBPUSD could rise towards 1.2600

What Happens to the British Pound: Second Referendum

The only hope that the British Pound has for a significant recover is if Brexit is avoided altogether: after all, it will be impossible to replace the economic activity lost endured from leaving the EU, the world’s largest single market. In the event that the next UK prime minister has a change of heart and takes steps to avoid Brexit (e.g. a second referendum or withdrawing Article 50), EURGBP could fall back towards 0.8300, GBPJPY could rally back towards 145.00, and GBPUSD could climb back towards 1.4000; a full-scale recovery back to pre-June 2016 Brexit vote levels is highly unlikely in the immediate aftermath of the cancellation of Brexit.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides