NORDIC FX, NOK, SEK WEEKLY OUTLOOK

- EURSEK pushing to re-test 2009 highs

- USD-Nordic FX crosses continue to rise

- USDNOK traders brace for Norges Bank

See our free guide to learn how to use economic news in your trading strategy !

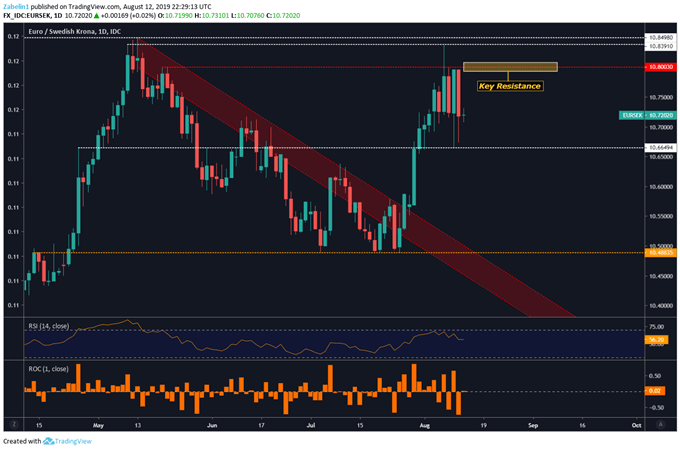

EURSEK TECHNICAL ANALYSIS

EURSEK recently attempted to re-test the former 2009 high from May after trading below descending resistance from the previous peak (red parallel channel). Looking ahead, the pair may continue to extend gains but my fall short of intimidating resistance at 10.8003 (red dotted line). If the pair manages to break through this barrier, it may linger before attempting to re-test the critical 10.8391/8498 resistance range (white dotted lines).

EURSEK – Daily Chart

EURSEK chart created using TradingView

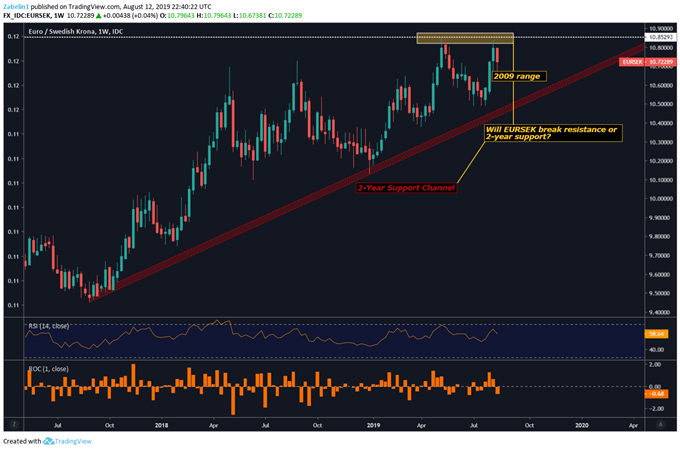

Zooming out to a weekly chart shows the pair has been steadily climbing along a rising two-year support channel. Upside momentum appears to be strong, though directional preference for the pair may be revealed if it breaks above key resistance at 10.8529 or below the two-year support channel.

Which Will Break First: Resistance or Support?

EURSEK chart created using TradingView

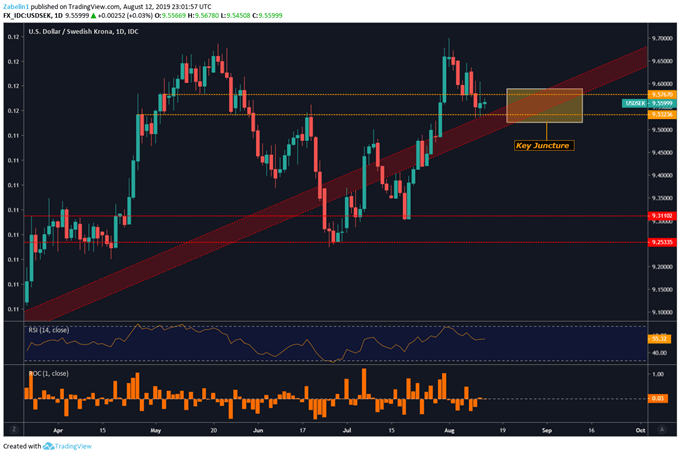

USDSEK TECHNICAL ANALYSIS

USDSEK is still trading within a familiar congestive range (yellow dotted lines) after briefly hovering above 17-year highs. Traders will cautiously monitor the pair as it approaches the junction between rising support (red parallel channel) and the consolidative zone. The path of least resistance suggests an upward bias though not necessarily on the same incline.

USDSEK – Daily Chart

USDSEK chart created using TradingView

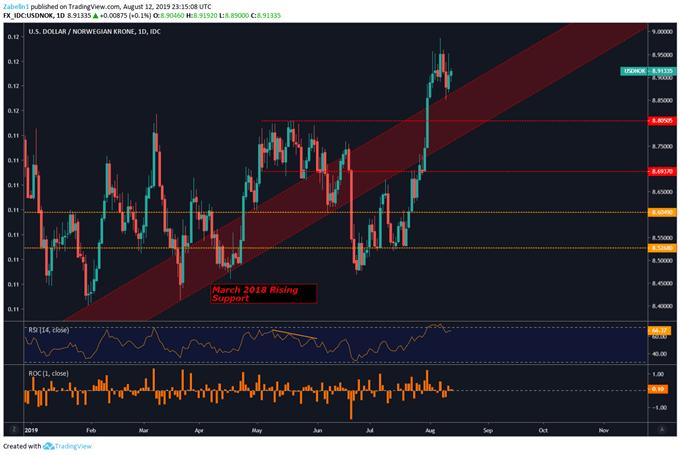

USDNOK TECHNICAL ANALYSIS

USDNOK traders with long positions are likely rejoicing now that the pair appears to be resuming the prior uptrend (red parallel channel). However, investors may avoid adding exposure until the Norges Bank announces its rate decision and outlook for policy going forward. There is a chance the central bank will surprise more dovish and could cause USDNOK to spike.

USDNOK Resuming Prior Uptrend?

USDNOK chart created using TradingView

SWEDISH KRONA, NORWEGIAN KRONE TRADING RESOURCES

- Join a freewebinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter