Crude Oil Technical Highlights:

- WTI Crude oil trying to hold above resistance, top of channel

- Brent crude less ambitious, channel structure keeps pointed higher

To see what fundamental drivers are expected to drive oil through the remainder of the quarter, check out the Q2 Crude Oil Forecast.

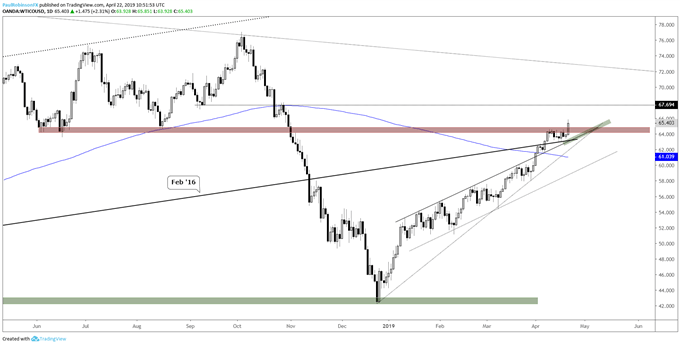

WTI Crude oil trying to hold above resistance, top of channel

Crude oil is trading strongly higher today with fears the U.S. to end Iran trade waivers, extending the rally out of a consolidation pattern. The WTI contract has recently been stuck between lows from June and August and the Feb ’16 t-line and channel slope from January.

There is still much trading left in today’s session, but we will have to see if the 2% shot higher can maintain above the lows from last summer. A reversal back below will put pressure on the aforementioned angled lines. The top-side slope from January has numerous inflection points since then and is viewed as a significant line of support in the near-term.

As long as the upper parallel holds then the bias will be neutral at worst. A break below the parallel and December trend-line will be required to turn the outlook to the downside. Tactically speaking, it is a tough spot to initiate fresh longs, but for those holding from lower prices today’s break above resistance may leave room to hold on for more upside follow-through. There is a minor swing point in the 67s to watch as resistance in the near-term.

WTI Crude oil Daily Chart (Trying to break resistance, stay above upper slope)

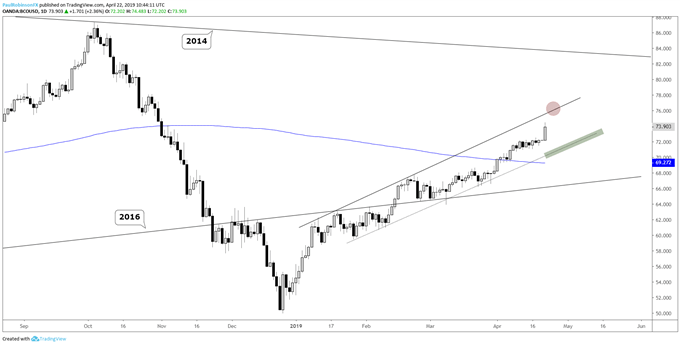

Brent crude less ambitious, but channel structure keeps pointed higher

Brent crude oil continues to trade within the confines of the channel starting back in January. The upper parallel has yet to have to been met and will be watched as a possible spot for the Brent contract to struggle at. As long as the lower parallel holds, then the trading bias is neutral to higher.

Brent crude oil daily chart (channel keeps it bullish)

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX