ASEAN Technical Outlook – USD/MYR, USD/SGD, USD/IDR, USD/PHP

- Malaysian Ringgit prices weakened against USD as the 2016 downtrend line broke

- Singapore Dollar could gain as a bearish reversal pattern in USD/SGD developed

- Indonesian Rupiah at Asia Financial Crisis lows, Philippine Peso eyes resistance

Read this week’s ASEAN fundamental outlook to see how forecasts compare with respective technical analysis!

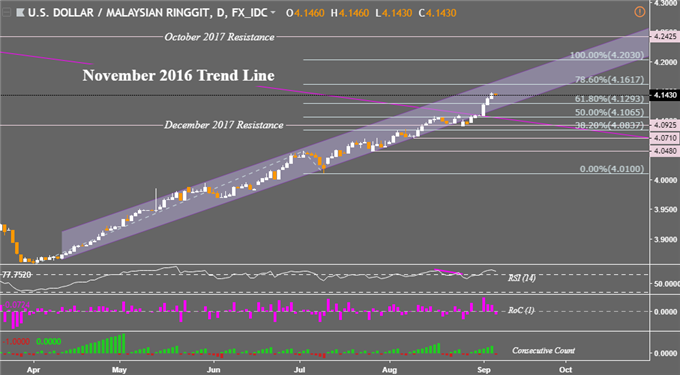

USD/MYR Technical Analysis – 2016 Downtrend Broken

The Malaysian Ringgit’s breakout of a rising channel against the US Dollar last week did not last long. The November 2016 trend line failed to keep USD/MYR at bay as the pair pushed above it. With the long-term downtrend since then now overturned, this opens the door to eventually reaching October 2017 resistance at 4.2425. But getting there involves pushing above immediate resistance at 4.1617 followed by 4.2030.

USD/SGD Technical Analysis – Bearish Reversal Pattern

The Singapore Dollar also weakened against its US counterpart in recent days, but the next leg in USD/SGD could be lower. A shooting star bearish reversal pattern has formed just under near-term resistance at 1.3818. A break under the near-term rising support line could support the argument that the pair will reverse course. Such an instance exposes the 14.6% minor Fibonacci extension at 1.3682 followed by the rising trend line from June.

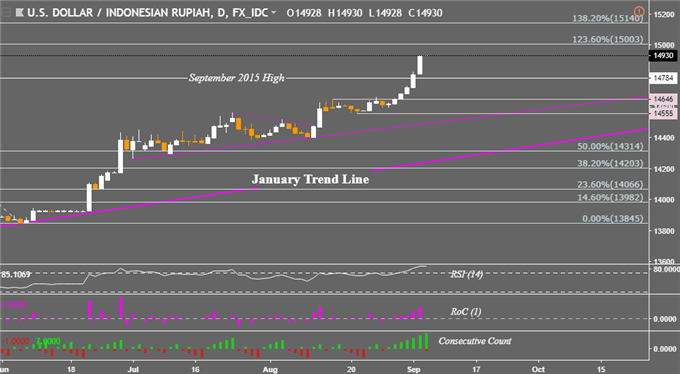

USD/IDR Technical Analysis – 20+ Year Highs

The Indonesian Rupiah weakened against the US Dollar in recent days to closes last seen during the Asian Financial Crisis, over twenty years ago. Since then, prices have now breached above the September 2015 highs above 14,784. With that came USD/IDR’s longest rising streak since early March. Near-term resistance is the 123.6% Fibonacci extension at 15,003. Immediate support could be the September 2015 highs.

USD/PHP Technical Analysis – Upside Momentum Resuming?

The Philippine Peso overcame fading upside momentum against the US Dollar as its near-term uptrend resumed course. USD/PHP is on its longest winning streak (6 consecutive days) since August 14th, 2017 or more than a year ago. Near-term resistance at 53.74 is holding up (June high) and may keep the pair at bay. A descent through the rising line exposes the 23.6% Fibonacci extension.

Check out our 3Q forecasts for currencies like the US Dollar in the DailyFX Trading Guides page

**All Charts Created in TradingView

FX Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter