USD/CAD Forecast: Neutral

- USD/CAD falls to critical support after Jerome Powell confirms extension bond purchases at the Jackson Hole Symposium

- Rising Oil prices Support and Supply Shortages may further support a stronger Canadian Dollar

- USD/CAD Big levels with breakout potential in either direction

USD/CAD rates have fallen back to a critical level of support after reaching a fresh yearly high just last week. With both fundamental and technical factors contributing to the recent retracement from the August high of 1.295, the Loonie currently remains confined to trendline support.

Although US economic data has been more bullish than that of Canada in recent months, a slightly more hawkish tone from the July FOMC Meeting minutes that supported US Dollar strength has dissipated with Fed Chair Jerome Powell confirming an extension of bond purchases despite signs of an overheated economy.

As the USD gave up its gains, the CAD, which has benefited from the rise in the price of US Crude Oil, gained traction, causing USD/CAD to fall as bears look to drive prices back towards the July low of 1.24.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -9% | -6% |

| Weekly | 48% | -10% | 3% |

USD/CAD Technical Analysis

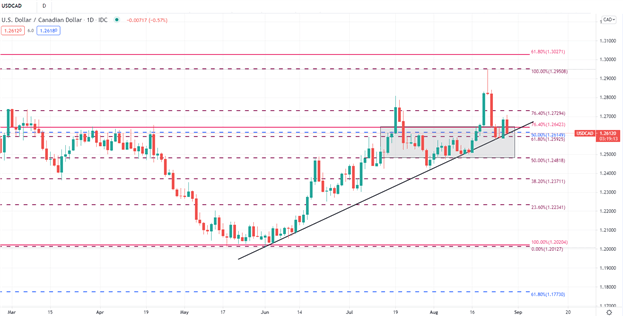

USD/CAD is currently bouncing around a critical level of support on the technical front. Firstly, the key level of support coincides with key Fibonacci levels of historical moves. The 1.263 level is both the 76.4% retracement of the 2020 – 2021 move and is also the 50% retracement of the historical high and low (2002 High and 2007 Low).

To learn more about price action or chart patterns, check out our DailyFX Education section.

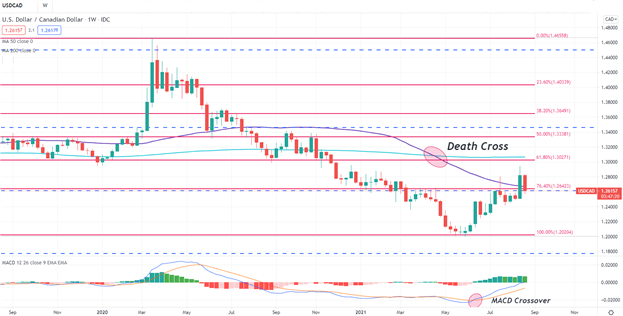

After a steady fall from the March 2020 high of 1.47, the formation of a death cross on the weekly time-frame confirmed the bearish trajectory for the Loonie allowing prices to fall back to the key psychological level of 1.20 in June before climbing higher. However after failing to break above 1.30, the formation of an Evening Star confirmed that bullish momentum had lost steam, allowing sellers to regain control over the short-term trend.

USD/CAD Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

However,for now, the rising trendline from the July low continues to hold firm as support suggestive that USD/CAD bulls aren’t ready to surrender just yet.

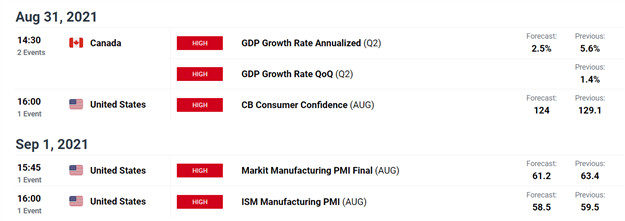

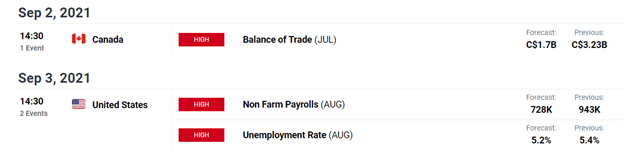

Although Dollar weakness may continue to support the bearish trend for now, the spread of the Delta variant combined with next week’s fundamentals which include Canadian GDP, Balance of Trade and US Non-Farm Payrolls may still result in heightened volatility, driving prices in either direction.

USD/CAD Daily Chart

Chart prepared by Tammy Da Costa using TradingView

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707