July FX Seasonality Overview:

- “Sell in May and go away” hasn’t been a real phenomenon for the US S&P 500 in recent years.

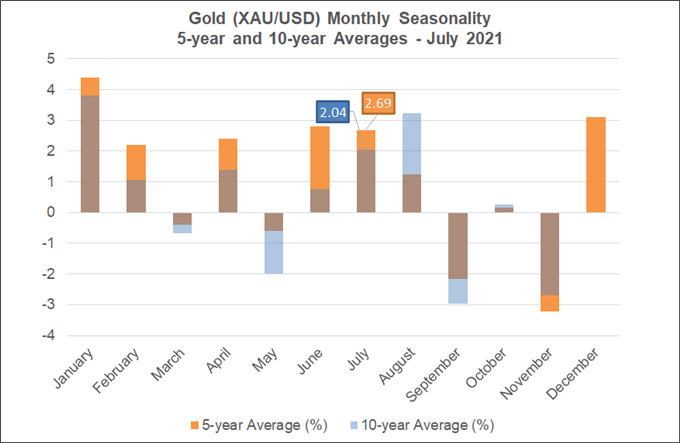

- It’s one of the best times of the year for gold prices, which have been under pressure ever since the June Federal Reserve policy meeting.

- Declining US rate hike odds at the start of the month coupled with unfavorable seasonality metrics suggests traders should be cautious about the US Dollar’s rally.

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. For July, our focus is on the trailing 5-year and 10-year performances, both of which fully capture trading during the era of quantitative easing and expanding government deficits since the 2008/2009 Global Financial Crisis – not dissimilar from the environment we find ourselves in during the coronavirus pandemic recovery.

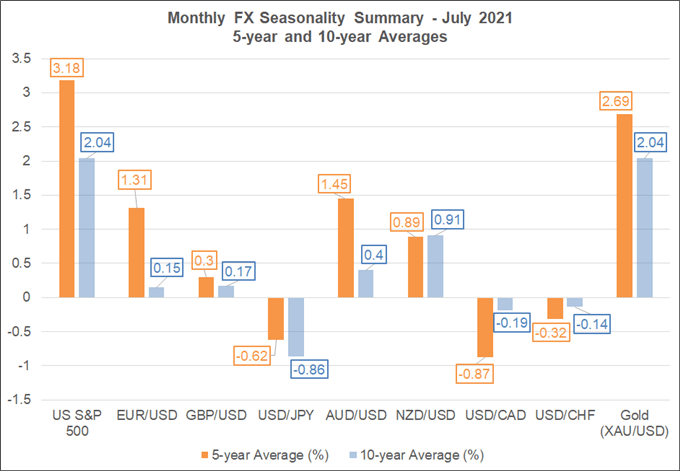

Monthly Forex Seasonality Summary – July 2021

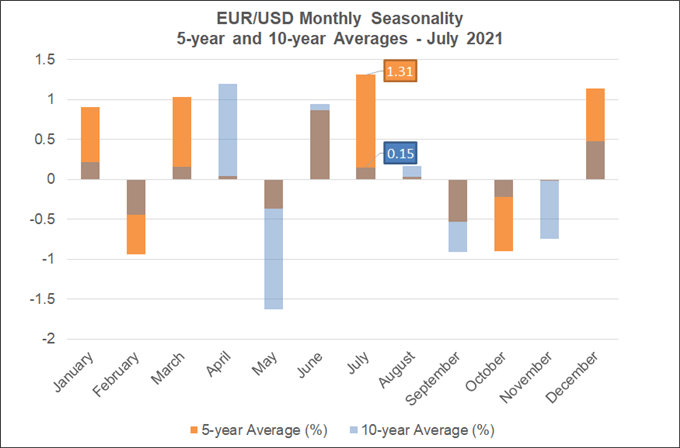

Forex Seasonality in Euro (via EUR/USD)

July is a bullish month for EUR/USD, from a seasonality perspective. Over the past 5-years, it has been the best month of the year for the pair, averaging a gain of +1.31%. Over the past 10-years, it has been the fifth best of the year, averaging a gain of +0.15%.

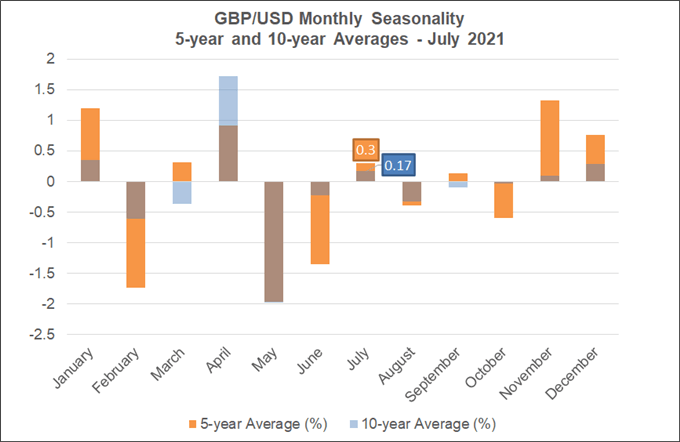

Forex Seasonality in British Pound (via GBP/USD)

July is a slightly bullish month for GBP/USD, from a seasonality perspective. Over the past 5-years, it has been the sixth best month of the year for the pair, averaging a gain of +0.3%. Over the past 10-years, it has been the fifth best month of the year, averaging a gain of +0.17%.

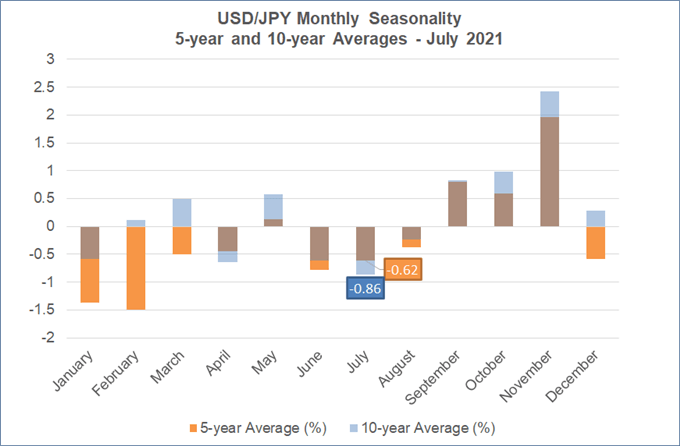

Forex Seasonality in Japanese Yen (via USD/JPY)

July is a very bearish month for USD/JPY, from a seasonality perspective. Over the past 5-years, it has been the fourth worst month of the year for the pair, averaging a loss of -0.62%. Over the past 10-years, it has been the worst month of the year, averaging a loss of -0.86%.

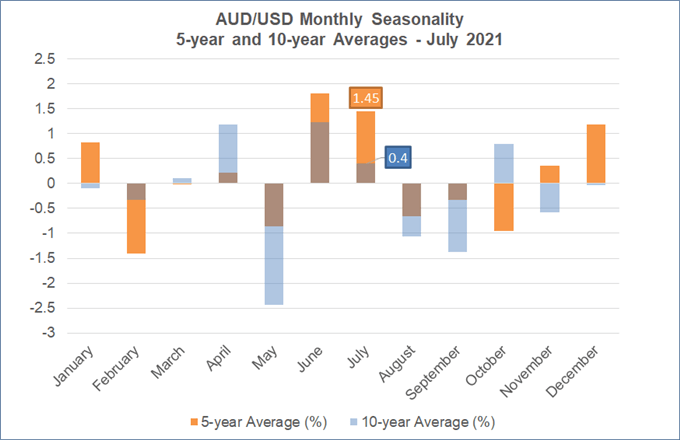

Forex Seasonality in Australian Dollar (via AUD/USD)

July is a very bullish month for AUD/USD, from a seasonality perspective. Over the past 5-years, it has been the second best month of the year for the pair, averaging a gain of +1.45%. Over the past 10-years, it has been the fourth best month of the year, averaging a gain +0.40%.

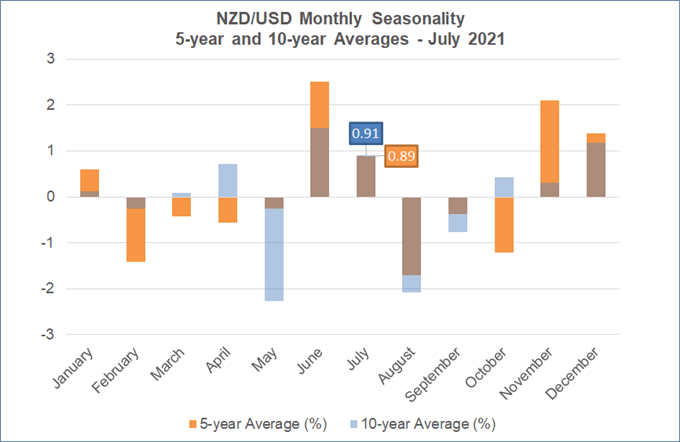

Forex Seasonality in New Zealand Dollar (via NZD/USD)

July is a very bullish month for NZD/USD, from a seasonality perspective. Over the past 5-years, it has been the fourth best month of the year for the pair, averaging a gain of +0.89%. Over the past 10-years, it has been the third best month of the year, averaging a gain of +0.91%.

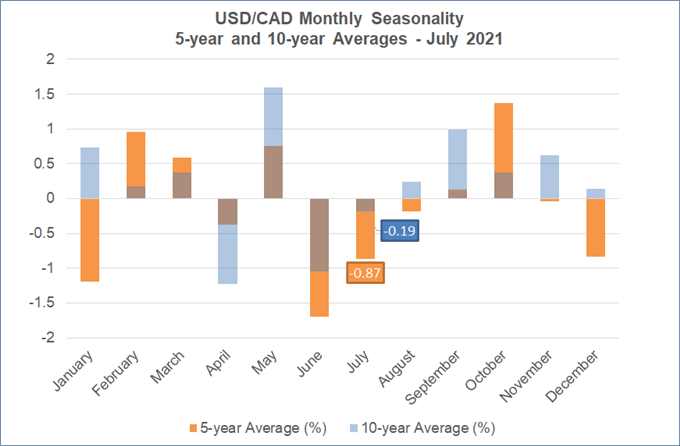

Forex Seasonality in Canadian Dollar (via USD/CAD)

July is a very bearish month for USD/CAD, from a seasonality perspective. Over the past 5-years, it has been the third worst month of the year for the pair, averaging a loss of -0.87%. Over the past 10-years, it has been the third worst month of the year, averaging a loss of -0.19%.

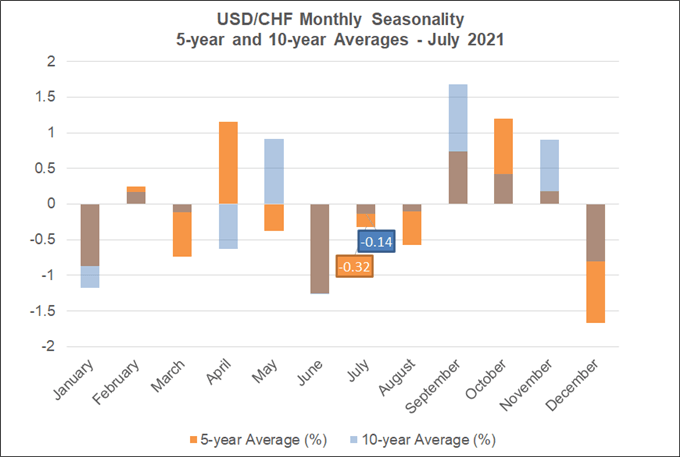

Forex Seasonality in Swiss Franc (via USD/CHF)

July is a slightly bearish month for USD/CHF, from a seasonality perspective. Over the past 5-years, it has been the seventh worst month of the year for the pair, averaging a loss of -0.32%. Over the past 10-years, it has been the fifth worst month of the year, averaging a loss of -0.14%.

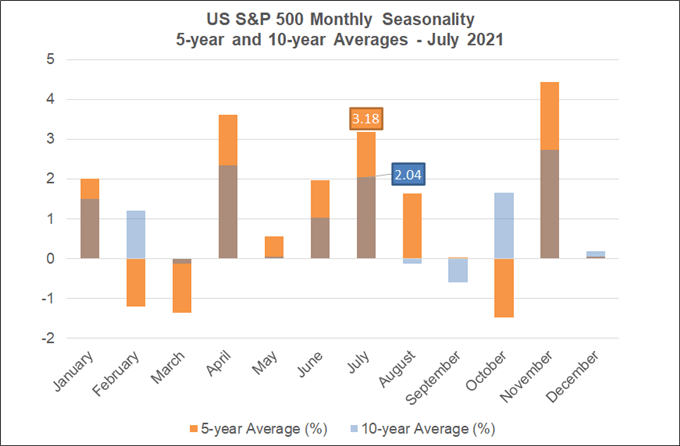

Forex Seasonality in US S&P 500

July is a very bullish month for the US S&P 500, from a seasonality perspective. Over the past 5-years, it has been the third best month of the year for the index, averaging a gain of +3.18%. Over the past 10-years, it has been the third best month of the year, averaging a gain of +1.02%. “Sell in May and go away” hasn’t been a real phenomenon recently.

Forex Seasonality in Gold (via XAU/USD)

July is a very bullish month for gold (XAU/USD), from a seasonality perspective. Over the past 5-years, it has been the fourth best month of the year for the precious metal, averaging a gain of +2.69%. Over the past 10-years, it has been the third best month of the year, averaging a gain of +2.04%.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist