EURO WEEKLY TECHNICAL FORECAST – BULLISH

- Euro price action continues to trade mixed across the board of major currency pairs

- EUR/USD bounces back from its bout of weakness to contend with trend resistance

- EUR/JPY looks like it could be gearing up for a breakout as upward pressure builds

- The DailyFX Education Center can help you improve your technical analysis skills

The Euro traded broadly mixed this past week. Euro strength was seen relative to its US Dollar and Yen peers, but the bloc currency weakened against the Pound, Canadian Dollar, and Australian Dollar. A fresh breath of air to the reflation trade theme appears largely responsible for the latest moves across EUR/USD, EUR/JPY, EUR/GBP, EUR/CAD, and EUR/AUD. This broader trend looks likely to continue so long as market sentiment stays sanguine.

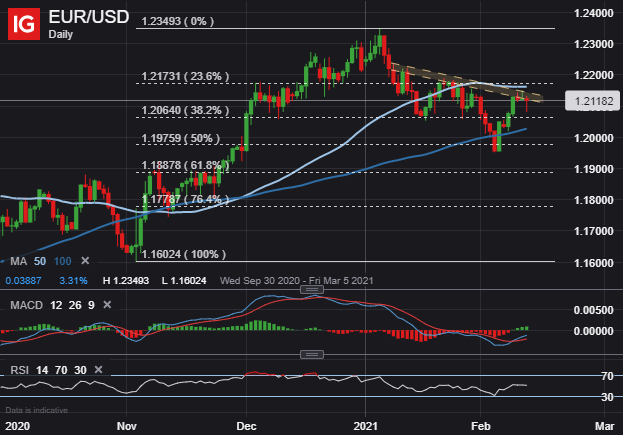

EUR/USD PRICE CHART: DAILY TIME FRAME (30 SEP 2020 TO 12 FEB 2021)

EUR/USD bulls defended the 1.2000-price level following a healthy 400-pip pullback by the Euro from its year-to-date swing high. On balance, the consolidation by EUR/USD price action leaves it coiled between the 50-day and 100-day simple moving averages. These technical barriers may keep EUR/USD relatively contained.

If the Euro can overcome its short-term bearish trend extending through the recent string of lower highs, however, the 1.2300-handle could come back into focus. That said, one-week risk reversals for EUR/USD have flipped positive again. Seeing that a risk reversal reading above zero indicates call option implied volatility is greater than put option implied volatility, this suggests FX options traders view EUR/USD price risk as being skewed to the upside.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 4% | 3% |

| Weekly | 0% | 10% | 3% |

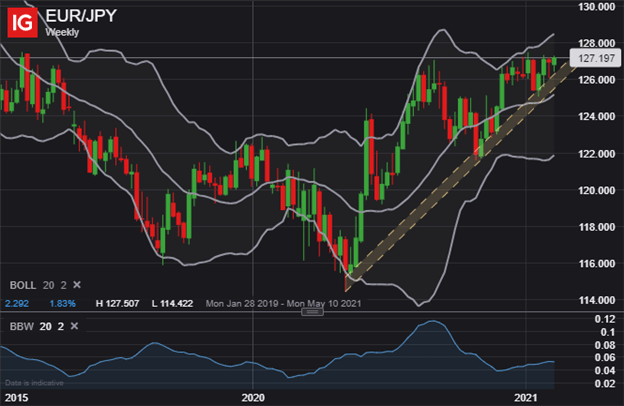

EUR/JPY PRICE CHART: WEEKLY TIME FRAME (28 JAN 2019 TO 12 FEB 2021)

EUR/JPY gained a modest 37-pips over the last five trading sessions. This pushed the Euro to its strongest level against the Yen since February 2019 on a weekly closing basis. Although, the current 127.00-price level, underpinned by 2019 and 2020 yearly highs, has presented a formidable obstacle for EUR/JPY. Another defensive act by Euro bears might push EUR/JPY price action back toward the 126.00-mark.

Potential Euro weakness may prove short-lived, however, as it looks likely for the broader bullish trend to prevail. This is highlighted by upward pressure building alongside the series of higher lows notched by since last May. To that end, if EUR/JPY bulls can take out its year-to-date high, it could open up the door to the 128.00-handle and upper Bollinger Band.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight