Weekly Technical USD/MXN Rate Forecast: Neutral

- USD/MXN rates are testing critical near-term support, which very well could be the determining factor in the predominant trading trend through the end of the year.

- While other currencies are benefiting from the US Dollar’s (via the DXY Index) weakness, the reliance the Mexican economy has on the United States has left the Peso struggling relative to other global growth-sensitive currencies.

- As a close proxy to USD/MXN rates, we can examine the IG Client Sentiment Index for USD/CAD rates to gain intuition on how traders are positioning in the Peso.

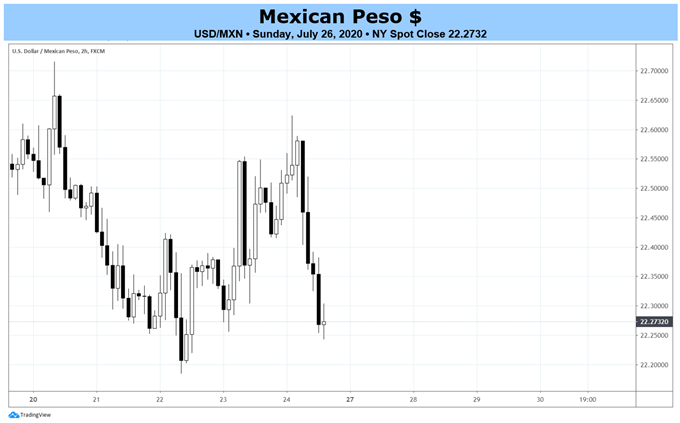

Mexican Peso Week in Review

The Mexican Peso proved stronger versus the US Dollar last week, with USD/MXN rates dropping by -1.15%, marking just the second time in seven weeks that the pair retreated. But limited gains over the past near-two months have left the pair vulnerable for a significant technical breakdown. Outside of USD/MXN, the Peso’s prospects appear limited: CAD/MXN rates continue to press higher, while other MXN-crosses against the majors are decidedly moving against the Peso’s favor.

Heading South of the Border?

There’s an argument to be made that USD/MXN rates have been consolidating in a symmetrical triangle since the end of February, contextually proving to have a bullish bias given the preceding directional move. Yet price action in recent weeks has been discouragingly weak, with no follow-through to the topside at a critical moment: just as price action moved into the terminal vertex of the triangle.

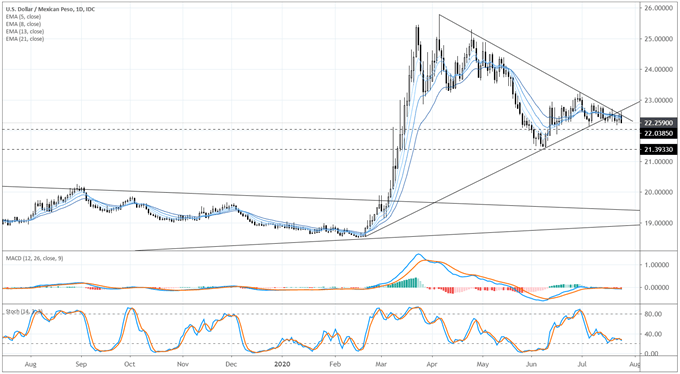

USD/MXN Rate Technical Analysis: Daily Chart (July 2019 to July 2020) (Chart 1)

To this end, given that trading is a function of both price and time, USD/MXN rates have continued to move sideways, but in context of respecting resistance within said triangle all the while breaching triangle support. The bearish outside engulfing bar on the daily chart to end the week, occurring as a failed attempt to retake triangle support, is a bearish omen for USD/MXN rates.

Concurrently, bearish momentum is starting to accelerate. USD/MXN rates are fully below their daily 5-, 8-, 13-, and 21-EMA, which is in bearish sequential order. Daily MACD is turning lower just below its signal line, while Slow Stochastics have started to decline again towards oversold territory. The path of least resistance is emerging to the downside in the short-term.

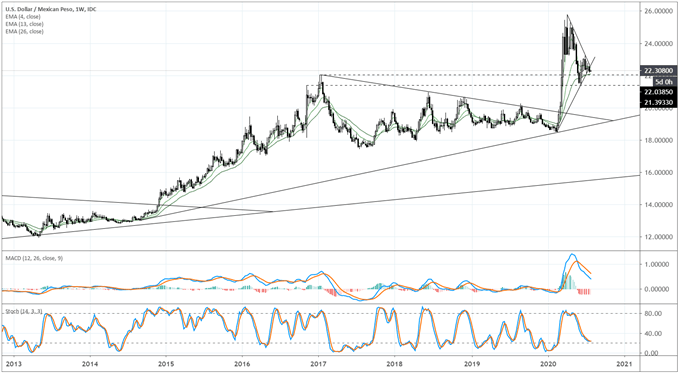

USD/MXN Rate Technical Analysis: Weekly Chart (July 2019 to July 2020) (Chart 2)

The prospective triangle failure warrants a review of longer-term timeframes. The 2017 high comes in at 22.0385, coinciding neatly with the weekly 26-EMA, equivalent to a six month moving average. Ultimate failure below this area would bring into focus the June lows once more at 21.459.

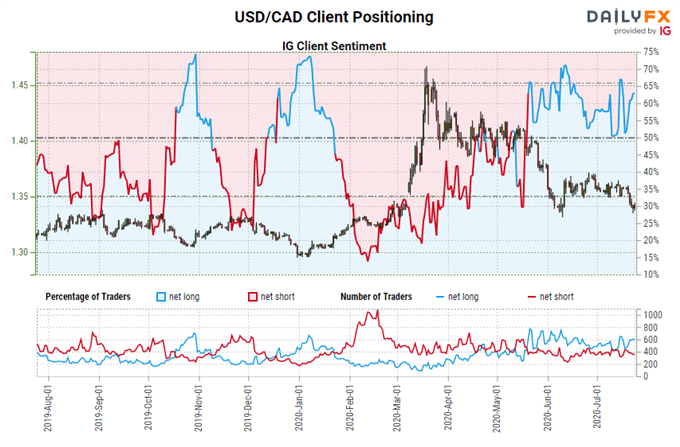

Using a Proxy to Track USD/MXN Retail Positioning

With respect to the difference in performance between USD/CAD and USD/MXN rates in recent weeks, it should be noted that the Canadian economy is more independent from the US economy than is the Mexican economy. While the United States is both countries’ largest trading partner, over 80% of Mexico’s exports go to the United States (compared to near 70% for Canada), while 30% of Mexico’s GDP is derived from economic activities involving the United States (compared to 20% for Canada).

That said, the close proximity of both countries given their trade relationship with the United States also means that their currencies tend to trade in a similar fashion as well. To this end, the 20-day correlation between USD/CAD and USD/MXN rates is currently 0.65; one week ago, the 20-day correlation was 0.68.

IG CLIENT SENTIMENT INDEX: USD/CADRATE FORECAST (JULY 26, 2020) (CHART 4)

USD/CAD: Retail trader data shows 67.02% of traders are net-long with the ratio of traders long to short at 2.03 to 1. The number of traders net-long is 20.52% higher than yesterday and 39.44% higher from last week, while the number of traders net-short is 16.22% lower than yesterday and 27.60% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist