Nasdaq 100 Third Quarter Forecast:

- The Nasdaq 100 is an important index with a defined technical structure

- Breaching prior highs and key psychological barriers in its price recovery, the Nasdaq was a beacon of strength in second quarter and its technical layout is crucial as a result

- Major levels exist on other indices which are detailed further in the full third quarter equity forecast

Nasdaq 100 Technical Forecast for the Third Quarter

The Nasdaq 100 has become one of the most important indices in the world as it leads the way in the coronavirus recovery rally. With high exposure to market-leading stocks like Apple, Amazon, Facebook, Google and Microsoft, the tech-heavy index has grown into somewhat of a proxy for price action on other indices like the Dow Jones and S&P 500. As US indices can loosely dictate the direction of price action in other equity markets, it can be said the Nasdaq’s role in the current market environment is crucial.

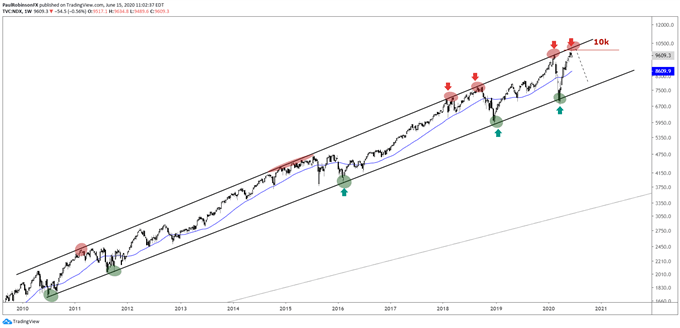

Nasdaq 100 Price Chart Weekly Timeframe (2009 to 2020)

Chart created in TradingView by Analyst Paul Robinson

Therefore, the defined technical structure within which the Nasdaq trades may serve to provide key insight into the health of broader equity price action. Nearing the topside of an ascending channel that has contained price for more than a decade, it is hard to entirely discard the threat of a reversal lower amidst the highly uncertain fundamental backdrop. For a deeper look into the Nasdaq’s technical structure as well as the fundamental outlook heading into the third quarter, read the full third quarter equity forecast by clicking the banner below.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX