Canadian Dollar Highlights:

- USD/CAD pullback supported in form of a March swing-low

- Sideways churn should resolve here shortly

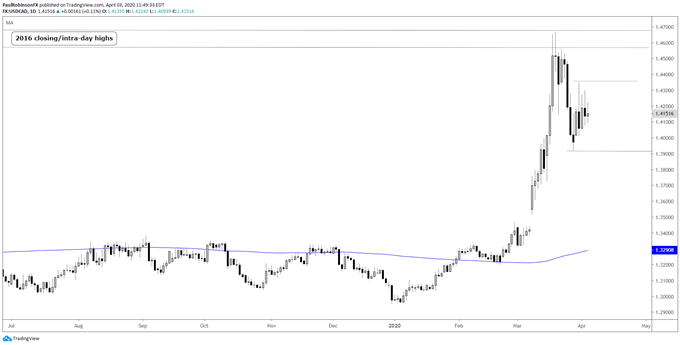

USD/CAD pullback supported in form of March low

This past week USD/CAD did little to help clarify the picture, with it chopping around – and violently so. The 300+ pip range on Tuesday caught many market participants off guard, but as the week ground down so did the size of the daily ranges.

The narrowing range suggests we are closing in on a breakout. A bullish break will get it out of the short-term wedge, and with a push beyond 14390, it will have price well above the top-side parallel of a channel forming since the March 18 high.

If the upward trajectory since the beginning of the year dictates, then we should see higher levels towards the March peak forged at the 2016 highs, and beyond. If, however, we see a breakdown from here, then the March 27 low at 13920 will come into play. To keep things still ordered towards the bullish side, it is ideal if this level holds.

For now, USD/CAD is stuck in short-term limbo but should resolve itself in the near-term in the coming days. We will want to maintain flexibility as market conditions are rapidly changing the chart-scapes. Broadly speaking, though, the USD still looks poised to rally further against CAD even if in the near-term we see some weakness first.

USD/CAD Daily Chart (trend pointed higher)

USD/CAD 4-hr Chart (looking to break free)

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX