Crude oil managed an incredible wedge break this past week, thanks wholly to a massive gap higher to start the week. There are a range of other markets – S&P 500, EURUSD, Gold and others – that are staged in their own tight trading pattern and prone to breaking. Yet, will these market find better traction in follow through than what we saw from the key commodity?

Aussie Price Outlook: AUD/USD Bears Re-Appear, More Room to Run?

Aussie bears re-appeared this week after taking a hiatus earlier in September, following the fresh decade lows set last month.

S&P 500, DAX & ASX 200 Technical Forecast

S&P 500 recovers from hawkish Fed with record high in sight. DAX makes another test of key trendline resistance, while ASX 200 eyes rate cut signal from RBA Governor.

Euro Price Chart: Breakout Imminent EUR/USD Coils at Trend Support

Euro snapped a two-week winning streak with price ranging just above long-term downtrend support. Here are the levels that matter on the EUR/USD weekly chart.

Crude Oil Weekly Technical Outlook: Price May Continue to Fade

The oil spike last week was quickly reversed, more selling may be ahead in the days ahead with potential soon for a full reversal of the gap.

GBP/USD Price Analysis: British Pound Eyes Rise in Brexit Risk

The Pound Sterling has surged roughly 3% so far this month as British MPs took measures toward preventing no-deal Brexit, but the recent rally is running into resistance as Brexit uncertainty reemerges.

US Dollar Facing Measured Breakout and In Its Long Grind Higher

The US Dollar has generally advanced for 18 months, though progress has certainly come in starts and fits. We are likely to see one of these short-term bursts of volatility in the week ahead.

Gold Prices Weekly Technical Forecast, Finding Upside Commitment?

The gold weekly technical forecast is neutral as XAU/USD looks to find follow-through after an upside push on Friday. Gold needs to take out September highs to resume its uptrend.

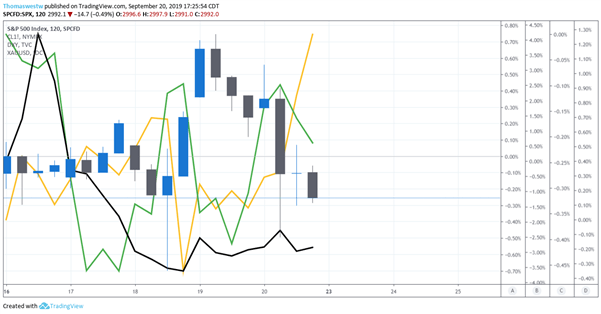

Chart Legend:

Oil = Black

DXY = Green

XAUUSD = Gold