Sterling Price Outlook: British Pound Recovery Faces First Test

- British Pound recovery now targeting initial test of trend resistance- 1.2374-1.2433 Critical

- Check out our 2019 projections in our Free DailyFX GBP/USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Sterling prices rebounded off downtrend support last week with the rally now targeting initial resistance targets. IF broken, the recent move in price would suggest that a larger recovery / advance is underway in the Pound. Here These are the updated targets and invalidation levels that matter on the GBP/USD weekly price chart. Review my latestWeekly Strategy Webinar for an in-depth breakdown of this gold price setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

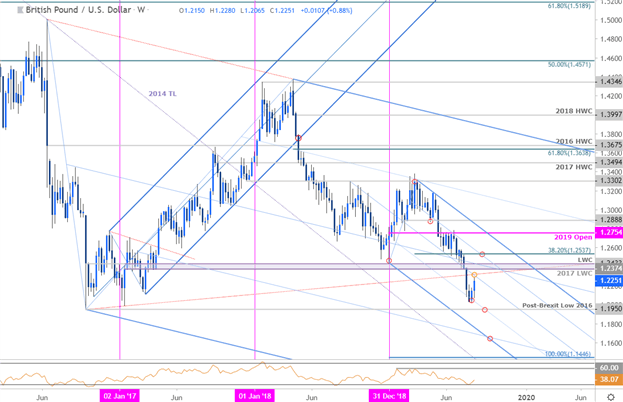

Sterling Price Chart - GBP/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; GBP/USD on Tradingview

Notes:In last week’s GBP/USD PriceOutlook we noted that Sterling was, “testing down-trend support here and leaves the immediate short-bias vulnerable into the start of next week.” The British Pound is up more than 2% off the monthly / yearly lows with the advance now targeting more significant downtrend resistance.

The median-line of the descending pitchfork formation we’ve been tracking off the late-2018 / 2019 highs converges on the 2016/2017 slope line around ~1.2315 with critical resistance steady at 1.2374-1.2433- a breach / close above this region would be needed to suggest a more significant low is in place. Initial support rests with the low-week close at 1.2144 – weakness beyond this point would once gain look to target the 2016 post-Brexit low.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line:The Sterling price recovery remains viable with the advance now targeting initial topside objectives. From a trading standpoint, look to reduce long-exposure / lower protective stops on a move towards downtrend resistance. Pullbacks should be limited to 1.2144 IF prices are indeed heading higher with a breach targeting 1.2374-1.2433 key pivot zone- watch the weekly close here. Review my latest GBP/USD Price Outlook for a closer look at the near-term GBP/USD technical trading levels.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

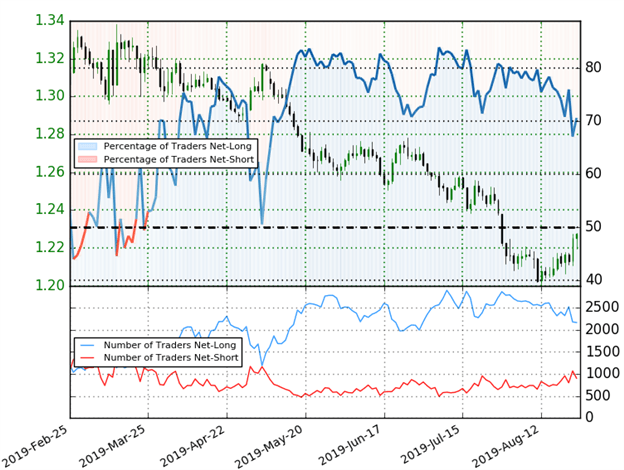

Sterling Trader Sentiment (GBP/USD)

- A summary of IG Client Sentiment shows traders are net-long GBP/USD - the ratio stands at +2.5 (71.5% of traders are long) – bearish reading

- Traders have remained net-long since May 6th; price has moved 5.6% lower since then

- Long positions are10.0% lower than yesterday and 6.4% lower from last week

- Short positions are 6.4% higher than yesterday and 10.0% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Sterling prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week. Recent changes in positioning warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in GBP/USD retail positioning are impacting trend- Learn more about sentiment!

---

Previous Weekly Technical Charts

Learn how to Trade with Confidence in our Free Trading Guide

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex