Gold Price Technical Outlook:

- Gold could use some more horizontal work before trading higher

- Longer-term the bias remains the same, more rallying ahead

For the intermediate-term fundamental and technical outlook, check out the Q3 Gold Forecast.

Gold could use some more horizontal work before trading higher

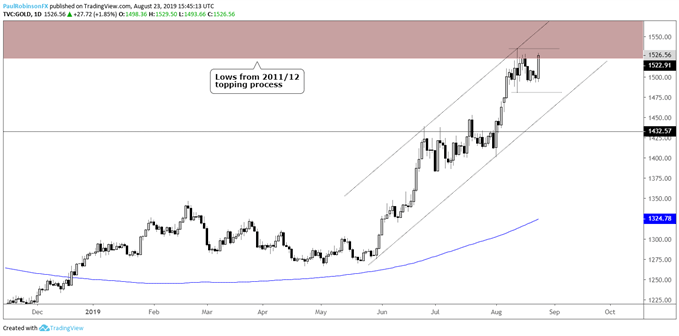

In the middle of the month gold ran into a major long-term resistance zone from around 1520 up to 1575, created in the wake of the bull market spike-high in 2011. Since then we have seen gold cool off, but in a constructive manner.

The backing-and-filling process, outside of the volatile session on the 13th, had been gradual and suggestive of another run coming. Friday’s pop showed how twitchy gold is to the upside. It may take some more time to get a full-blown rally going, though; preferably it does, so a stronger base can get built to help propel price through long-term resistance.

If this is the case in the coming week, then look for a lack of direction in the near-term to continue. If price comes off a bit, an attractive spot to look for support is either 1480, the Aug 13th low, or the trend-line rising up from late May. From a tactical standpoint this could provide a nice backstop for longs, while leaving some good upside potential to trade back into the aforementioned resistance zone.

In the event gold continues to push higher beyond 1535, we will still need to be cognizant of the fact there is good resistance up until 1575. This makes it important to tread carefully with short-term longs as there could be some more push-back until the zone is cleared.

Keep in mind for the next couple of weeks, summer trading conditions likely won’t help the cause for a strong directional move. But this doesn’t mean if in front of the screens we can relax on managing existing risk.

Check out the IG Client Sentiment page to find out how changes in gold positioning could signal the next price move.

Gold Price Weekly Chart (big overhead resistance)

Gold Price Daily Chart (acting well so far)

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX