Equities Technical Forecast

- S&P 500 uptrend is being undermined by weakening momentum

- Nikkei 225 is running out of room to consolidate in its uptrend

- Euro Stoxx 50 looks to confirm what could be a reversal ahead

Not sure where equities are heading next? We recently released the third quarter equities fundamental and technical forecast !

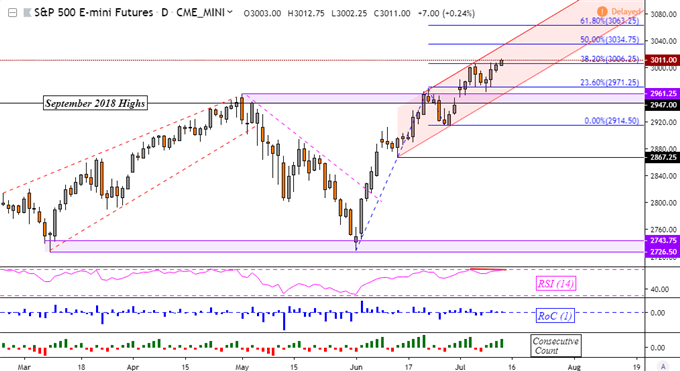

S&P 500 Outlook:Neutral

The S&P 500 traded cautiously to the upside this past week, fundamentally propelled by dovish testimony to Congress from Fed Chair Jerome Powell who prepared markets for a cut later this month. Taking a look at S&P 500 futures below, showing afterhours trade, the index appears to be confined within a rising channel from earlier this month as it took out September 2018 highs and set new records.

Yet, negative RSI divergence shows that momentum to the upside is weakening and at times, this can precede a turn lower or translate into consolidation. That places support as the floor of the rising channel which is closely aligned with the 23.6% Fibonacci extension at 2971. Beyond that are the peaks in April. Otherwise, uptrend resumption has resistance as channel top, with more aggressive gains exposing 3063.

S&P 500 Futures Daily Chart

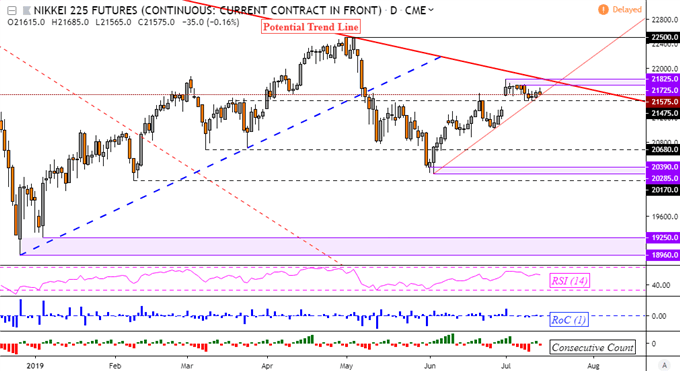

Nikkei 225Outlook: Neutral

Crossing the Pacific and turning our attention towards Japan, the Nikkei 225 spent this past week consolidating under resistance which is a range between 21725 and 21825. This area is also closely aligned with what appears to be a potential descending trend line from September 2018. That may keep the dominant downtrend from the latter-half of 2018 intact in the coming days should prices attempt to push higher.

Simultaneously, the Nikkei 225 is being supported by a rising trend line from the beginning of June. As such, the index is running out of room to consolidate and could be in the process of constructing its next medium-term move. With technical analysis, confirmation is key when looking at a breakout either to the upside or downside. For the latter, keep an eye on support at 21475 which may hold.

Nikkei 225Futures Daily Chart

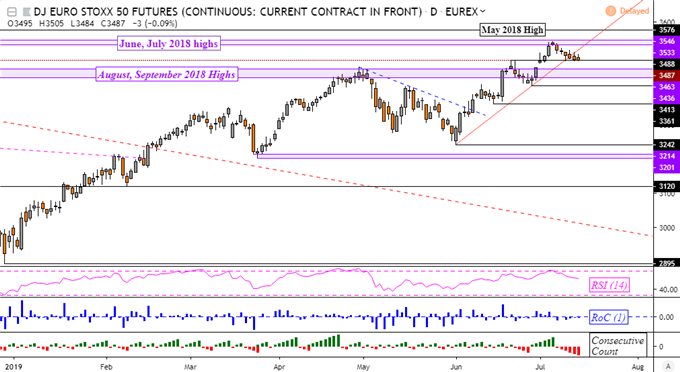

Euro Stoxx 50 Outlook:Slightly Bearish

Further west, the Euro Stoxx 50 traded cautiously to the downside, taking out rising support from the beginning of June. While that is a bearish warning sign, further confirmation is required to argue that the index could reverse its uptrend from last month. It is possible that we get that in the week ahead is support is taken out at 3488, opening the door to testing highs from August and September 2018.

That is a range of former resistance between 3463 and 3436 which may reinstate itself as support. If that is then taken out, that would open the door to eventually reaching 3242. Meanwhile, near-term resistance appears to be the June and July 2018 highs between 3533 and 3546 which may prove difficult taking out. In such a scenario, the next psychological barrier appears to be at 3576, the May 2018 high.

Euro Stoxx 50 Futures Daily Chart

* Charts created in TradingView

FX Trading Resources

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter