Sterling (GBP) Technical Analysis

- GBPUSD descending wedge formation continues.

- EURGBP starting to look toppy.

- GBPJPY breaks trend but move may be overdone in the short-term.

Q2 Trading Forecasts for a wide range of Currencies and Commodities including GBP with our fundamental and technical medium-term technical outlook.

How to Combine Fundamental and Technical Analysis.

Technical Forecast for Sterling (GBP): Neutral

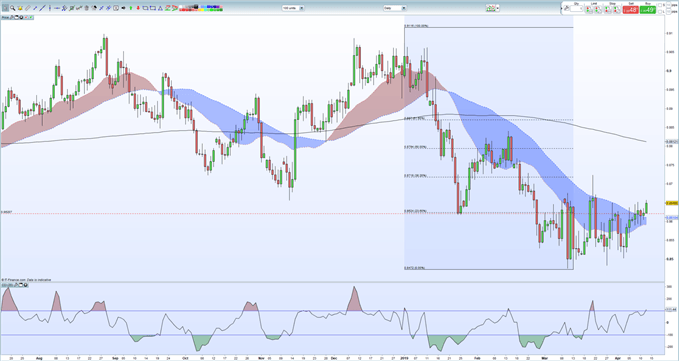

GBPUSD continues to trade above 1.3000, a temporary Soft Brexit ‘line in the sand’, but other forces are now in play which could see this level tested again. A downward wedge from the March 13 high at 1.3382 is seemingly in control of price action with the floor around the March 11 low at 1.2960. Trading ranges of late have been tight with traders seemingly growing tired of the ongoing Brexit saga and looking elsewhere for opportunities. A break below 1.3000 would see the floor of the wedge under pressure as well as the important 200-day moving average which has provided support since February 19. If broken, the 23.6% Fibonacci retracement level at 1.2894 comes into play. A clear break and close above the downtrend would see the 38.2% Fib retracement at 1.3177 as the first target.

GBPUSD Daily Price Chart (May 2018 – April 12, 2019)

How Central Banks Impact the Forex Market

EURGBP continues to grind higher off the April 3 low and has added the best part of 1.5 cents with just one down day. The 0.8649 recent high has been touched today and a close above here would leave important resistance at 0.8718 (38.2% Fib) and the March 21 spike at 0.8723 as valid targets. Above here, two further Fibonacci retracement areas and the 200-day moving average would cap momentum. The CCI indicator at the bottom of the chart suggests the market is becoming overbought and this may temper further upside in the short-term. To the downside there is congestion all the way back down to the recent low at 0.8472, a low previously seen nearly two years ago.

EURGBP Daily Price Chart (July 2018 – April 12, 2019)

Interest Rates and the Foreign Exchange Market

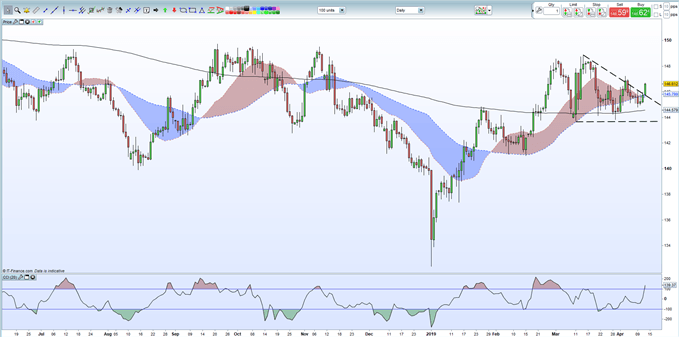

GBPJPY has made a notable upside move today, breaking out of a restrictive wedge and above the 20- and 50-day moving averages. The pair have been supported by the 200-day ma since mid-February and a close above tend could see GBPJPY push higher. The move may be slowed by the overbought signal from the CCI indicator. Support should start around 144.58 off the 200-day moving average before the recent low and wedge bottom at 143.65. Further bullish sentiment could see the recent 148.88 high under threat.

Looking for a fundamental perspective on the GBP? Check out the Weekly GBP Fundamental Forecast.

GBPJPY Daily Price Chart (June 2018 – April 12, 2019)

DailyFX has a vast amount of resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of constantly updated Educational and Trading Guides

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Technical Forecast:

Australian Forecast– AUDUSD Flirts with 200 Day Moving Average, AUDJPY Earns Strong Break