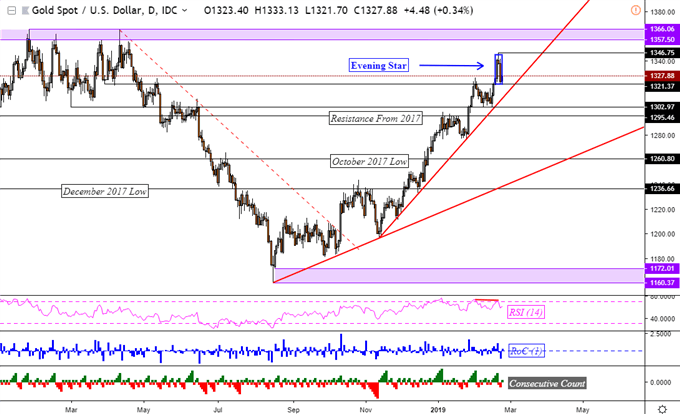

Gold Technical Forecast: Bearish

- Gold’s 1,321 break stalled, resulting in fresh reversal warning signs

- Bullish interests are undermined by an evening and shooting star candles

- There is also potential for head - and - shoulders pattern to form

Find out what the #1 mistake that traders make is and how you can fix it!

Last week, I noted that fading upside momentum was clouding gold’s dominant uptrend stretching back to August 2018. Despite this, bulls pushed it above key resistance at 1321.37. The commodity couldn’t get far after the breach though, ending the week by trimming most of its upside progress. With a persistent negative RSI divergence, there are growing indications that a turn lower could be in the cards soon.

On the daily chart below, the threat of a turn is emphasized by an evening star candlestick pattern at gold’s recent high. This is typically a bearish reversal formation. If prices turn lower in the week ahead, they will be facing a rising support line dating back to November followed by 1302.97 which is the March 1 low. If we get a turn higher at that area back to 1321.37, the commodity may even form a head and shoulders bearish reversal pattern. The neckline of the formation would be at 1302.97.

Looking for a fundamental perspective on gold? Check out the Weekly Gold Fundamental Forecast.

Gold Daily Chart

Chart Created in TradingView

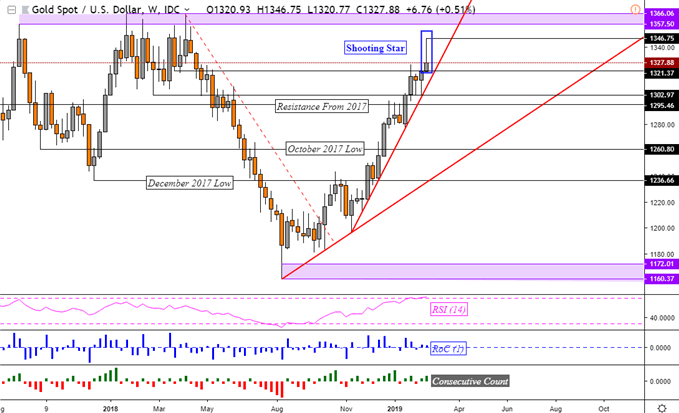

Gold Weekly Chart

If we zoom out to the weekly chart, the sharp turn lower in gold prices towards the latter half of last week created a shooting star candlestick. This is a sign of indecision which may precede a more steadfast downtrend if gold prices close next week even lower. In the event that this doesn’t happen and the commodity climbs above resistance, the next area of interest seems to be between 1357.50 – 1366.06.

This heavy resistance is not only the zone highs established between January and April of 2018, it is trendline resistance that touched off with the March 2014 swing high. Taking this analysis into consideration, the risks seem to be tilted to the downside and the technical forecast turns bearish.

Chart Created in TradingView

FX Trading Resources

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Australian Dollar is viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Other Weekly Technical Forecast:

Australian Dollar Forecast – AUD/USD, AUD/JPY and AUD/NZD Eye Trend-Forecasting Patterns

Oil Forecast– Bears May Want to Turn Away, Momentum is Here

British Pound Forecast – Selling Off Into Support

US Dollar Forecast – Dollar Faces Volatility Potential but Breakout and Trends are Still Far Reach