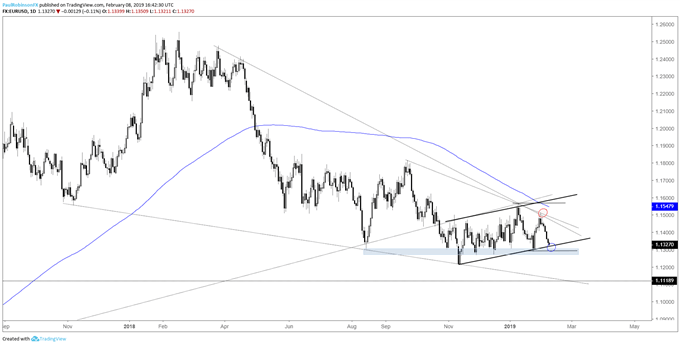

EUR/USD Technical Highlights:

- Euro is trading from resistance to support

- Bounce looks likely, a break would be reason to turn more aggressively short

Check out the Euro Q1 Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

Euro is trading from resistance to support

Last week, the Euro furthered weakness off confluent trend-line resistance. The move from resistance already has big support in view as the trading range remains quite narrow in historical terms. Only a small handful of times has the 6-month range ever been this tight.

In the current environment fade trades off significant levels have been the only tactical approach working. Next week may bring another such opportunity if either the lower parallel holds or price maintains the zone from around 11320 down to 11268, with price support the most meaningful.

The 11300-level became important back in August, with the area just surrounding it having become an inflection point of support on numerous occasions since late October. The more times a level or price zone is tested the more meaningful it becomes.

While the immediate environment indicates the best approach is to fade key levels, at some point we are very likely to see EUR/USD make quite a large move. Price action is getting about as pent up as it has been at anytime since the Euro’s existence. A strong close below 11268 doesn’t of course guarantee that we see a big surge in momentum, but given the trend, importance of support, and volatility conditions it may indeed be get us much closer to the tipping point…

Traders are generally long EUR/USD, see the IG Client Sentiment page to find out how changes in positioning can act as a signal for price direction.

EUR/USD Daily Chart (Big support close at hand)

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Other Weekly Technical Forecast:

Australian Dollar Forecast – Australian Dollar Strength Falls Apart, Can AUD/CAD Breakout Last?

Oil Forecast – Bullish Backdrop Remains Despite Weekly Drop

British Pound Forecast – GBP Down But Not Out

US Dollar Forecast – Dollar Matches Longest Climb Since November 2016, Is it a Trend?