EUR/USD Technical Highlights:

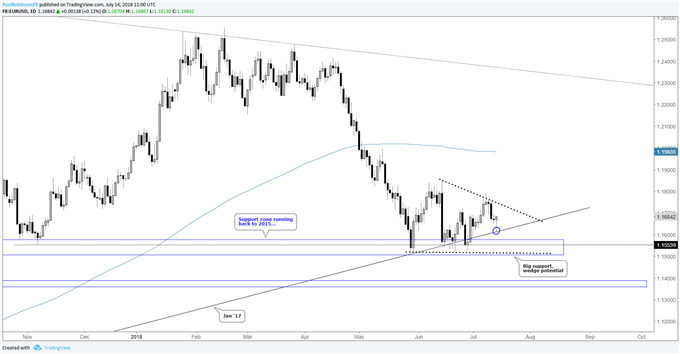

- EUR/USD higher low on ‘hidden’ support could be in the works

- Or, a big retest of the low-11500s could also be in store, or

- Another week of range-bound, summer trading conditions

Check out our intermediate-term fundamental and technical perspective on EUR/USD in the recently released DailyFX Q3 Euro Forecast.

The last few days brought with them the potential for yet another test of major support in the low-11500s, an area EUR/USD has held on three occasions since late-May. Will it hold, fold, or was Friday’s decline and recovery the carving out of a higher-low from not so obvious support?

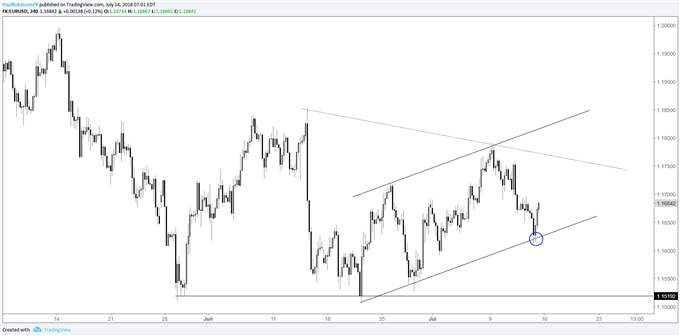

There is a trend-line from January 2017 running through the bottom of recent price action which also coincides with a lower parallel on the 4-hr chart, this could provide the means to put in place a higher low. However, a break below the lower-parallel/trend-line and an important test of big-picture support will likely develop.

If a higher-low has in fact developed as of Friday, or very close to doing so, then a move higher next week could gain traction. But the euro has its work cut out for it if this is the case, with an upward hill to climb.

On a decline down to around 11500 the market will test buyers’ resolve. A fourth hold will keep the euro buoyed, and bring to light the distinct possibility of a descending wedge formation maturing in the days/weeks ahead. A break below key support will have price resuming its downhill roll from the spring.

Whether we are in for a higher-low, a test and hold of the low-11500s, or breakdown in the week ahead, it looks like it could be another important stretch of days. Or, the euro may be in for some summer doldrums and bounce around with little conviction in either direction.

Gotten a little off track? It’s happens. Check out these 4 ideas to help rebuild your confidence.

EUR/USD Daily Chart

EUR/USD 4-hr Chart

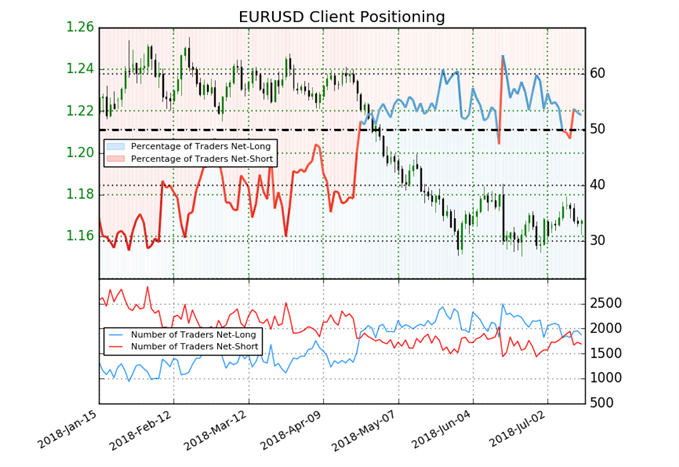

EUR/USD Sentiment

As per IGCS, traders are effectively net flat at a ratio of 1.09, which looks about right when taking recent price action into consideration. Should we see a sudden jump in traders shorting (bullish) or buying (bearish) it could be a sign of pending momentum given the recent lull. To see more details regarding sentiment and how it acts as a contrarian indicator, check out the IG Client Sentiment page.

EUR/USD IG Client Sentiment

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX