- EUR/USD and USD/CHF follow through on outside weekly reversals

- NZD/USD trendline is just below .6800

- USD/JPY low is at the 200 week average

-- Subscribe to Jamie Saettele's distribution list in order to receive a free report to your inbox several times a week.

--Check out the DailyFX Trading Guides and webinars for ideas and education.

Weekly (LOG)

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

I’ve noted long term EUR/USD bottoming conditions recently such as the key reversal in January, divergence with RSI (monthly and weekly) and the channeling decline. However, the follow through on the weekly outside reversal doesn’t exactly inspire confidence in near term (at least) upside. What’s more, the rally from January is left as a 3 wave advance at this point and ‘counts’ as a 4th wave within a 5 wave decline from the 2016 high. The implication is that a 5th wave lower is underway to at least 1.0200 (measured target based on wave 1 = wave 5).

Weekly

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

GBP/USD has been trading sideways since the October crash in what may be a triangle. The end of the quarterly declines mentioned last week shouldn’t be forgotten however. “For the 3rd time in history, a string of 6 consecutive down quarters has ended. The prior to instances were major lows but also resolved with clean quarterly reversal candles. Q1 just carved an inside bar.” As such, I’m still open to both sides within the range and must acknowledge the possibility of an A-triangle B scenario from the October low.

Weekly

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

Every AUD/USD poke into .7700-.7800 over the last year has failed. The main consideration for resistance up there are from parallels. As long as price is below the parallel, longs are fighting an uphill battle. After the February top, I noted that “the dip could extend to the October and December 2015 highs at .7385.” That level is back in play again.

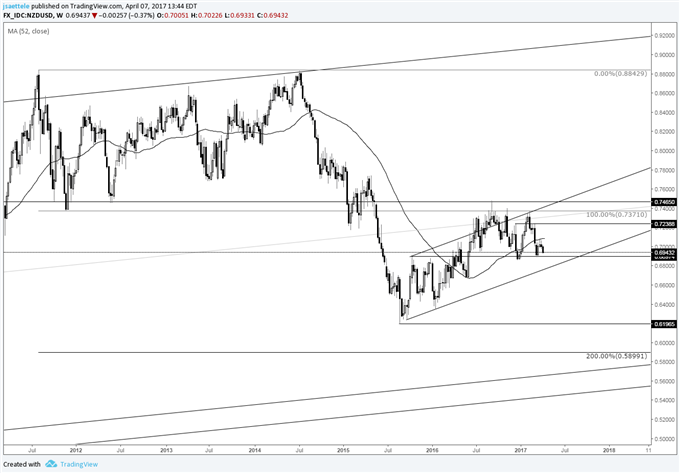

NZD/USD

Weekly

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

Don’t forget about the 2015-2016 trendline just below .6800 in Kiwi. Bigger picture, I’m still lost. Is the rally from August 2015 countertrend or a new trend? The 2016 and YTD highs are at major resistance from the 2011 low and a double top target is still unmet at .5899. A break under the 2015-2016 trendline would suggest a good deal more downside. Until then, keep an open mind.

USD/JPY

Weekly

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

Last week’s update noted that “a major USD/JPY level could be met in April. The 52 week average (support and resistance for years) is near 108.30 and the 50% retracement of the decline is at 108.81 (the 1991 high was a 50% retracement of the 1990 decline by the way). The decline from the January high would consist of 2 equal legs at 108.49. This zone (108.30/81) intersects with the developing channel from the January high in mid-April.” These levels should still be monitored but the last 2 weeks have found demand above 110.00, which is also the 200 week average. This average has historically served as a decent long term pivot. Weekly RSI stalling near 50 is also interesting. The dips throughout 2013 and 2014 resulted in RSI bottoming near 50.

Weekly

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

There is no change to the USD/CAD weekly comments, which continues to tread water under range highs. “The USD/CAD rally from May 2016 is corrective so the bias is for impulsive weakness but the proximity of a long term parallel to the December high increases risk of a bull trap on a push through the horizontal level (failed breakout). However, the March high is a few ticks below the 52 week closing high so it’s possible that USD/CAD is ready for its next leg lower. Weekly RSI has been failing near 40 since late 2016 which is bearish behavior.”

USD/CHF

Weekly

Chart Prepared by Jamie Saettele, CMT

See REAL TIME trader positioning

My USD/CHF focus has been on the trendline that originates at the September 2011 low. The line has been support on every touch since 2015 (including the US election). Of course, the latest dip didn’t even reach the line! Like EUR/USD (inverse) price has followed through on the prior week’s outside reversal. The 55 week average was also support at the low. The bullish outside week and follow through is a great way to begin a directional leg. The line that connects the 2012 and 2015 (twice) highs is resistance just below 1.0500.