- EURUSD holds March-May line

- USDJPY key level is month-to-date high at 123.71

- USDCHF holds key support on Friday

-- Subscribe to Jamie Saettele's distribution list in order to receive a free report to your inbox several times a week.

--For more analysis and trade setups (including current positions and the ‘watchlist’), visit SB Trade Desk

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“Since the March low, EURUSD has rallied sharply and declined sharply. The decline from the May high ended near the 61.8% retracement of the March-May advance. Daily RSI briefly poked above 70 at the May high and bottomed at 40 at the May low. These observations are consistent with a sideways market at worst and possibly the early stages of a larger rally. Even a test of the major breakdown level would result in a move to 1.20.”

-“If the broader move is higher then EURUSD needs to hold above the line that connects the March and May lows. That line produced support following the weekend gap from 1.1171.” EURUSD held that line this week (spiked below it intraday on Tuesday). A short term bearish parallel was broken on Friday too (not shown on this weekly chart). The tightening range since the May high could compose a triangle within a larger advance from the March low.

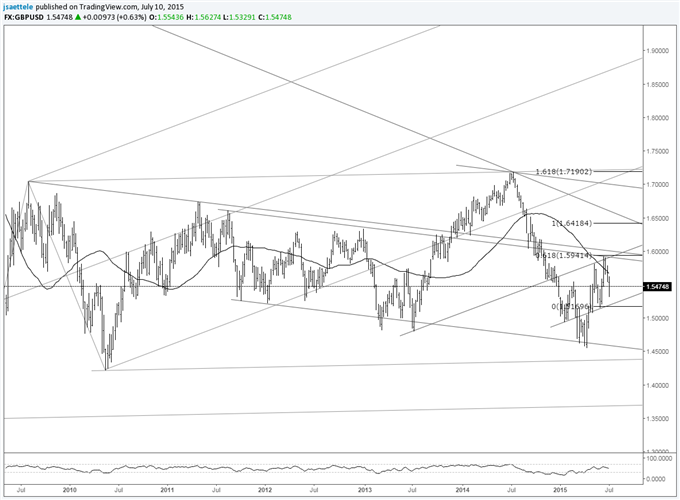

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“GBPUSD has broken above its 52 week average for the first time since September 2013. There are hurdles to clear from slope resistance (on various time frames) up to about 1.60. As such, a period of consolidation below 1.60 may be in store before an attempt on 1.64+ (2 equal legs from the April low).”

-1.5500 failed as support which shifts focus towards the next parallel near 1.5300. 1.5169 is the key level with respect to the broader (6+ months) bottoming pattern.

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“A slope confluence pinpointed the May high, which keeps the broader trend pointed lower. A long term level to be aware of in AUDUSD is the line that connects the 2001 and 2008 lows, which is near .7100. Be aware that the range that has been underway since April could persist for months and morph into a triangle or flat pattern.” The immediate picture is bearish as long as price is below .7740. Range expansion objectives yield .7143 and .6902.

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“One can’t help but notice that an epic double top is possible with a target of .5898. That would trigger on a drop below .7370.”

-“A bearish wedge pattern has formed and yields an objective of .6607.” Look towards the mentioned objectives (.6607 and .5898) as long as price is below .7230. A daily close above .6923 would warn of a near term bottoming attempt.

USD/JPY

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“A USDJPY breakout from the 6 month coil would open up 123.16-124.13 (high close from June 2007 and 2007 high). A measured objective from the pattern yields 125.72 and 128.12.”

-“USDJPY ended up trading to 125.85 (the mentioned 125.72 was the December range x .618 + the December high…basically a Fibonacci range expansion). Failure at long term uptrend resistance indicates potential for an important top to form. As I type, there are 2 days left in June and USDJPY is little changed for the month (month open is 124.10). In other words, a monthly doji could form…at a 20 year trendline (former support…may provide resistance now)!”

-“June’s trade produced a monthly key reversal in USDJPY.” The downside is favored as long as price is below the month-to-date high of 123.71.

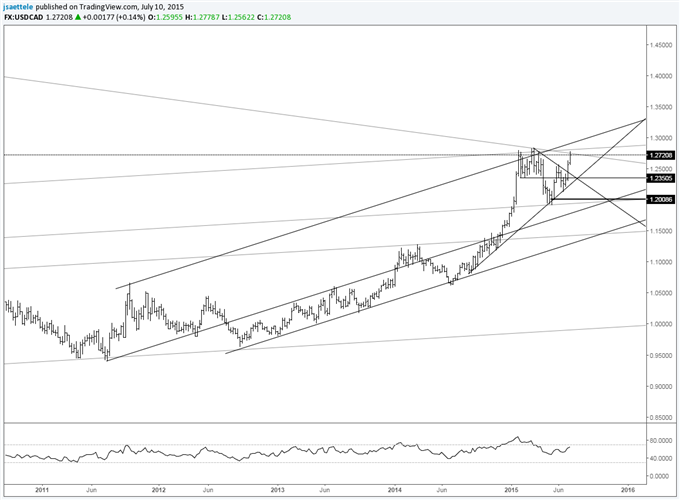

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“A broader range may in store. In fact, weekly RSI recorded its 2nd highest reading ever in Jan (only higher reading was in 1984). Other high periods led to extended periods of sideways trading. The failed run at a high volume level (1.2560) twice warns of additional range trading.”

-A 10 month trendline has supported USDCAD on recent dips. The development indicates potential for resumption of the broader bull move.

USD/CHF

Weekly

Chart Prepared by Jamie Saettele, CMT

Automate trades with Mirror Trader

-“The break above near term slope this week indicates a short term behavior change. .9250 needs to hold in order to look higher. Watch for resistance near .9600 (50% from the March high at .9599 and 2 equal legs from the May low at .9621).”

-“USDCHF dropped into .9250 this week (low was .9242) and promptly rocketed to .9500. Focus is higher as long as price is above .9242. The mentioned .9600 may provide resistance. Near term support is estimated at .9330. A break above .9600 would target .9913 (Fibonacci).” .9330 held as support on Friday (low was .9329) so look higher as long as price is above that level.