Currency Volatility GBP/USD Talking Points

- GBP/USD Implied Volatility Highest in G10

- Politics to Drive Pound Price Action

Top 10 most volatile currency pairs and how to trade them

GBP/USD | Weekly Range 1.2190-1.2475

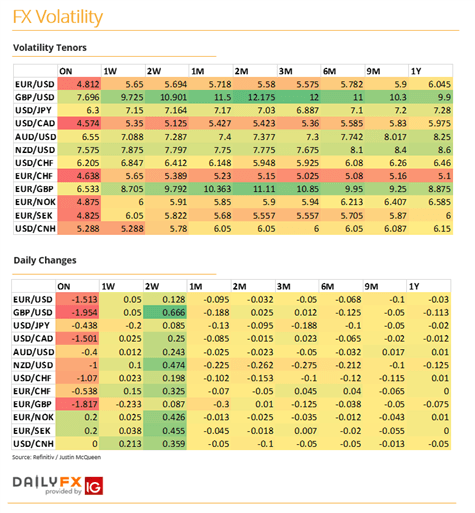

GBP/USD ATM break-even straddles = 132pips/9.725vols(meaning that for option traders to realise gains, the spot price must see a move greater than 132pips).

As we head towards the scheduled Brexit deadline of October 31st and following Boris Johnson’s Brexit proposals, headline risk has seen implied volatility in the Pound unsurprisingly elevated against its counterparts. A hope-fuelled bid in the Pound had stemmed from the EU being open to discussions in response to PM Johnson’s plan, however, with the EU noting that they are not convinced by the plan and with the Irish PM stating that it falls short in a number of aspects, differences for finding an agreement remain quite apparent. Thus, the uncertainty will continue to weigh on the Pound and the UK economy.

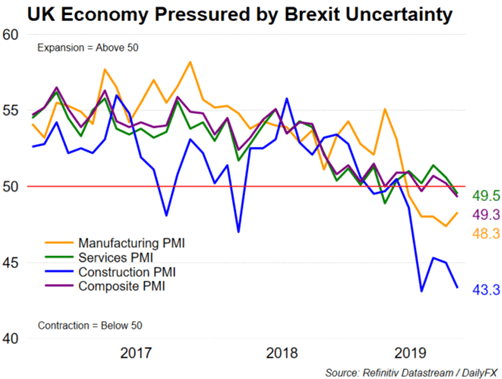

While politics will remain a key driver for the Pound, the monthly GDP report may also garner attention given that the latest PMI survey’s signal that the UK economy may have slipped into a technical recession. However, the PMI survey does tend to overstate the weakness of the UK economy during times of heightened political uncertainty.

Source: Datastream, DailyFX

For a more in-depth analysis on FX, check out the FX Forecast

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX