Currency Volatility US Dollar,GBPUSD Talking Points

- US Dollar | Fed Risk Boosts FX Volatility

- GBP/USD | BoE to Maintain Monetary Policy Stance

Top 10 most volatile currency pairs and how to trade them

We are continually looking to improve our service and your views can help us. Please let us know what you think via our Short Online Survey Here

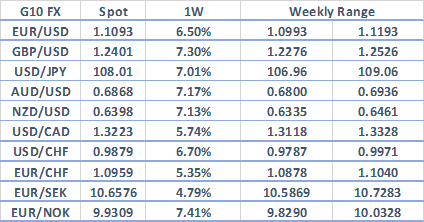

Source: Thomson Reuters, DailyFX

*Through calculating the 1-standard deviation estimated range, this suggests that there is a 68% statistical probability that these pairs will trade within this range.

Most Volatile Currencies This Week

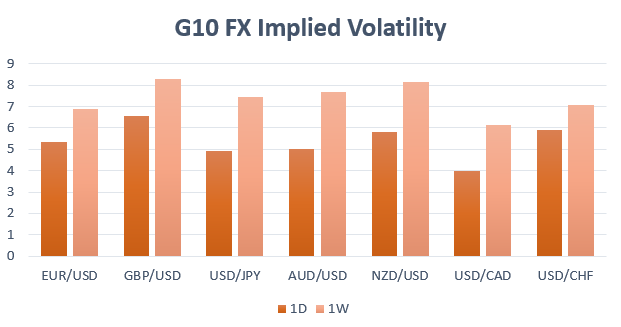

Source: Thomson Reuters, DailyFX

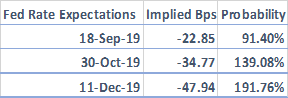

Fed Risk Boosts FX Volatility

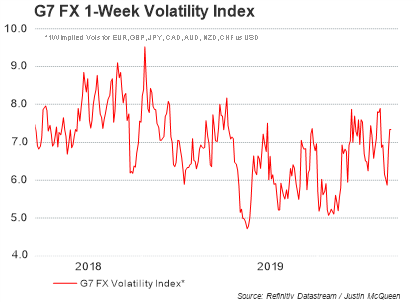

The 1-week FX volatility has continued to edge higher as option markets price in the risk premium regarding the Federal Reserve rate decision. While the central bank is expected to lower interest rates once again, the disappointment with regard to the dovish expectations priced in for Fed policy outlook may come in the fact that the Fed are unlikely to pre-commit to an easing path.

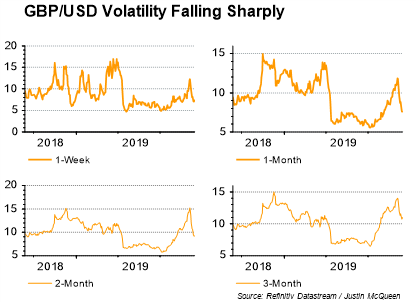

GBP/USD | BoE to Maintain Monetary Policy Stance

While the Pound is expected to be the most volatile currency next week as implied vols remain elevated. Volatility in the Pound has fallen sharply over the past week since no-deal Brexit risks have been diminished, while the suspension of parliament have also seen Brexit related headlines on the light side. As we look towards the week ahead, much of the focus for GBP watchers will be on the Bank of England monetary policy meeting. The BoE are expected to keep policy unchanged as the known unknown with regard to the Brexit outlook keeps the central bank on the side-lines. That said, while business sentiment surveys (PMI) suggest that the UK economy is stagnating, hard data, most notably the recent monthly GDP figure has eased recession fears in the UK economy.

GBP/USD 1-week ATM break-even straddles imply a move of 114pips(meaning that option traders need to see a move of over 114pips in either direction in order to realise gains). Alongside this, while 25 delta risk reversals are relatively neutral in short term tenors, the longer-term outlook remains tilted to the downside.

For a more in-depth analysis on FX, check out the Q3 FX Forecast

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX