Currency Volatility Talking Points

- Euro Implied Volatility Drops Post ECB

- EURUSD Volatility Maybe Under-pricing Fed and NFP Risk

Top 10 most volatile currency pairs and how to trade them

Most Volatile Currencies This Week

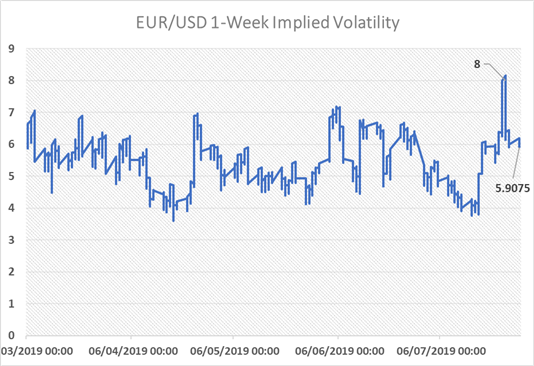

EUR/USD Implied Volatility Drops, Despite Key Data Releases

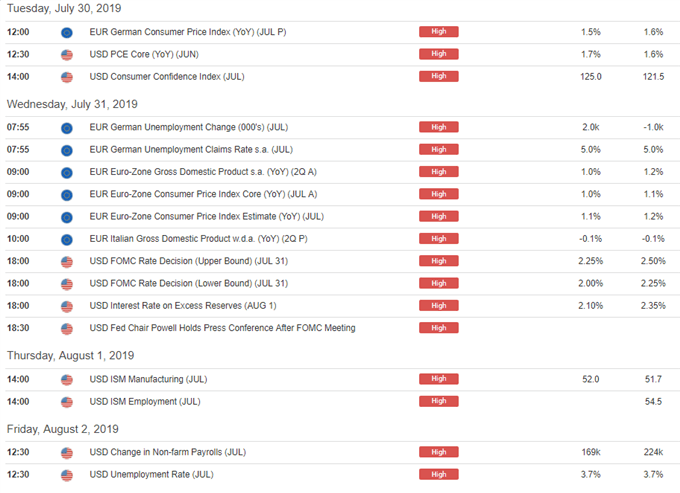

Since the ECB monetary policy decision, risk premium attached to the Euro has dropped from a peak of 8 vols (pre-ECB) to 5.9 vols. Consequently, 1-weekATM break-even straddles are at 73pips(meaning that investors would need to see at least a 73pip move above or below the strike price over the tenor to realise gains), which is down from the previous 99pip straddle. As such, given that there is a plethora of tier 1 data, most notably the Fed meeting, in which the central bank is expected to cut interest rates for the first time in over a decade. Alongside, notable Eurozone data which will have implications for the potential size and degree of fresh stimulus from the ECB. There is a possibility that EUR/USD could be somewhat under-pricing the risk that these data points poses with US data also finishing off with the latest NFP report.

Source: DailyFX

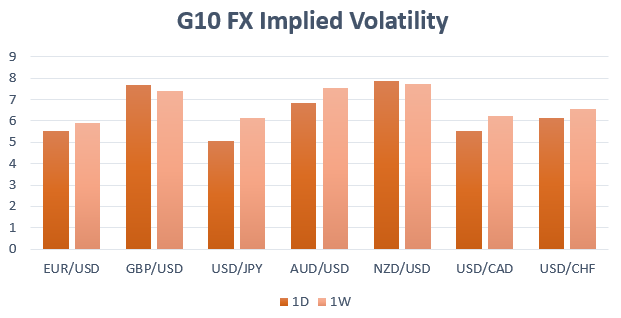

When comparing the implied volatility in the Euro relative to its G10 counterparts, it is notably lagging, despite that key data that is on tap. As a reminder, with the Fed meeting seen as the most important data point of the week, given that the Euro is the largest weight within the USD basket, any important changes within the Fed statement or Powell’s press conference is likely to impact the Euro more than its counterparts.

US Dollar Basket Weighting

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX