Currency VolatilityNZDUSD Talking Points

- NZDUSD Volatility Surges Ahead of CPI Report

- RBNZ Maintain Easing Bias

Top 10 most volatile currency pairs and how to trade them

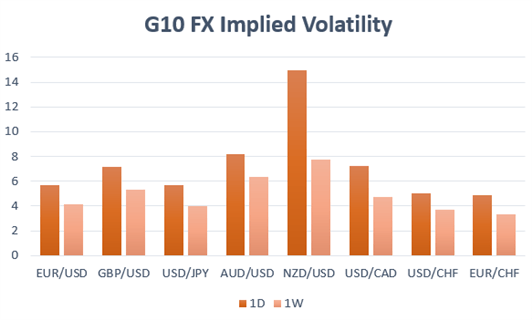

G10 FX 1D Implied Volatility

Source: Thomson Reuters, DailyFX

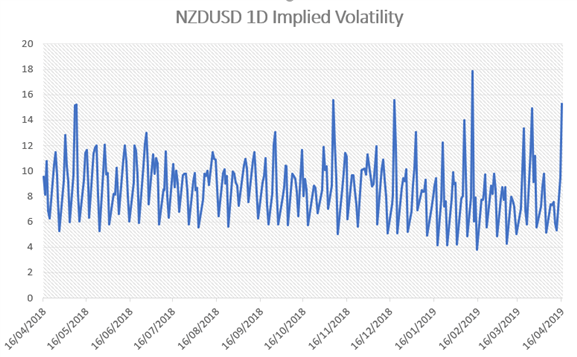

NZDUSD: With 1D option expiry covering tonight’s inflation report, NZDUSD implied volatility have jumped 4.6vols to 15.125, which in turn sees volatility at the highest in over 2-months. As such, this implies a move of 42pips. Alongside this, risk reversals continue to a show a premium for NZDUSD puts (downside protection) over calls, suggesting that option markets are continuing to bet on further declines.

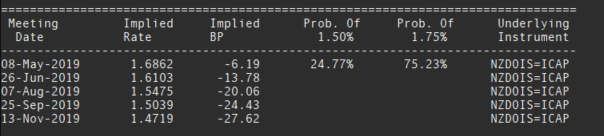

RBNZ Maintain Easing Bias

Overnight, saw the RBNZ Governor, Adrian Orr, state that the monetary policy easing bias is in place for now, while also dampening expectations over tonight’s inflation report, having highlighted that Q1 inflation undershooting forecasts (RBNZ forecast 1.6%) are already factored in to the bank’s dovish tone. Consequently, a lower than expected inflation report could see an increased risk that the RBNZ cut interest rates at the upcoming May meeting. As it stand’s OIS markets are attaching a near 25% chance that the RBNZ cut to 1.50% at the next meeting.

Key Data Points

- NZ CPI Q/Q Exp. 0.3% (Prev. 0.1%)

- NZ CPI Y/Y Exp. 1.7% (Prev. 1.9%)

- NZ CPI Sector Factor Prev. 1.7% (RBNZ’s preferred measure)

RBNZ Interest Rate Expectations

Source: Thomson Reuters

WEEKLY CURRENCY VOLATILITY REPORT

For a more in-depth analysis on FX, check out the Q2 FX Forecast

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX