Currency VolatilityGBPUSD and EURUSD Talking Points

- GBPUSD Volatility Remains Elevated, Brexit Extension Likely

- EURUSD Volatility Muted, Despite ECB and Fed Releases

Top 10 most volatile currency pairs and how to trade them

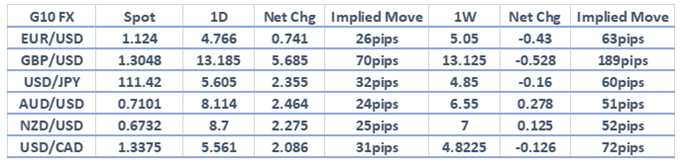

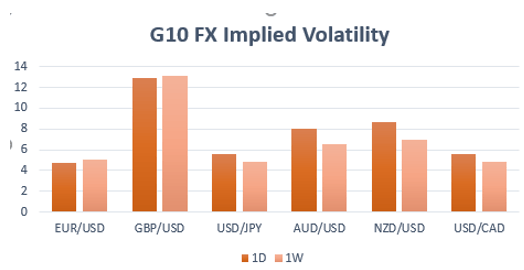

1D and 1W Implied Volatility

Source: Thomson Reuters, DailyFX

Take a look at our Brexit Timeline to see how negotiations have impacted the markets.

Across the G10 space 1-day implied volatility have picked up slightly, however, they continue remain at very muted levels, with the exception of GBPUSD for obvious reasons (Brexit). In a week that will see the release of the ECB April rate decision, Fed meeting minutes and likely Brexit extension announcement at the EU summit (Wednesday), 1-week vols have dipped slightly. In turn, this suggests that there may be little in the way of fresh policy signals in the ECB and Fed releases, while a possible Brexit extension seen as the most likely scenario.

EURUSD: While implied vols have picked up, EURUSD volatility continues to remain subdued with options implying a meagre move of 22pips. Tomorrow could see 1-day vols as this would cover the ECB, Fed, and EU summit. Both 1-day and 1-week risk reversals have edged closer to neutral as demand for Euro puts recede slightly, suggesting that the range in the pair may continue to hold. Implied move for the week at 63pips.

GBPUSD: Unsurprisingly, GBPUSD volatility is notably higher relative to its G10 counterparts, which sees an implied move of 189pips for the week. Given that headline risk continues to remain elevated the daily implied move sits at 70pips. 1-week and 1-month Risk reversals continue to show a sizeable premium for downside protection in GBPUSD as the Brexit uncertainty is likely to persist. Alongside this, with the latest COT report showing speculative positioning in GBP relatively neutral, there may be little in the way of a short squeeze on a Brexit extension announcement.

Source: Thomson Reuters, DailyFX

For a more in-depth analysis on FX, check out the Q2 FX Forecast

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX