THE MACRO SETUP OVERVIEW:

• The US Dollar is dominating markets as yields rise

• GBP traders set up for hawkish disappointment

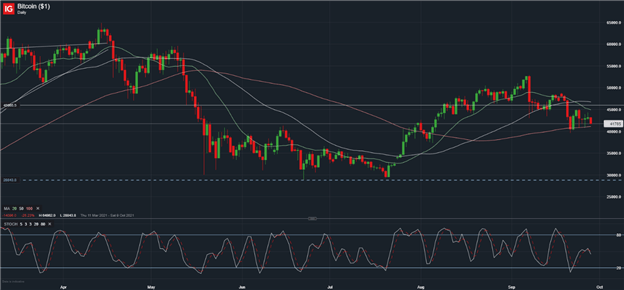

• Bitcoin sends a bullish signal as it holds above $40,000 despite China crackdown

DOLLAR DOMINATES AS YIELDS RISE

Global equities have been unable to fully recover from the pullback last week before they’ve been hit by another wave of selling. The S&P 500 hasn’t managed to climb back above its ascending trendline support, turning this area into short-term resistance, whilst the Nasdaq is bearing the full brunt of yield rises as high-value technology stocks underperform cyclical stocks when rate expectations are high.

The US 10-year yield, usually used as a key market gauge for inflation expectations, has shot up above 1.5% for the first time since June after a hawkish FOMC last week put traders on alert for a taper signal in November and a rate hike earlier than originally expected. This move in yields seems to be telling us again that markets are wanting the Fed to act on rising price pressures, with concerns about stagflation rising as higher prices don’t always go hand in hand with economic growth.

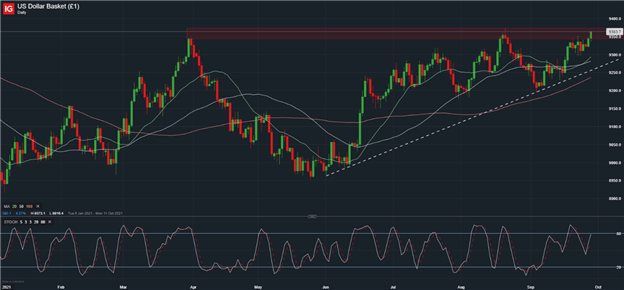

Key focus is also on the US Dollar, with the technical setup suggesting a strong bullish breakout. The Dollar basket has been bouncing off its trendline support since June which suggest continued buying pressure towards 94.00. This has caused some bias when looking at USD pairs, with USD/JPY being the one attracting the most attention on the basis of carry trade and monetary policy differentials.

The Pound is another interesting trade setup as it has mostly set itself up for disappointment on the back of monetary tightening being priced in by February 2022, leaving little room for the Bank of England to asses the effects of the end of the furlough scheme before markets are expecting a rate hike. GBP/USD has dropped below a key Fibonnaci support (1.3577) and is looking vulnerable to a further move lower throughout the coming weeks.

*For commentary from Dan Nathan, Guy Adami, and myself on the US Dollar, Bitcoin, Oil, and the Pound amongst others, please watch the video embedded at the top of this article.

CHARTS OF THE WEEK

DXY TECHNICAL ANALYSIS: DAILY CHART (CHART 1)

GBP/USD ANALYSIS: DAILY CHART (CHART 2)

BTC/USD TECHNICAL ANALYSIS: DAILY CHART (CHART 3)

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin