THE MACRO SETUP OVERVIEW:

- US stocks set another round of all-time highs

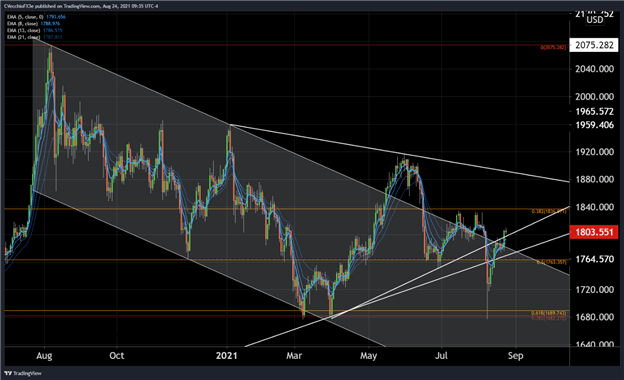

- Gold prices move back into consolidations after a false bearish breakout

- Fed rate hike odds lag US Treasury yield curve movement

JACKSON HOLE GOES VIRTUAL, AGAIN

In this week’s edition of The Macro Setup, featuring Dan Nathan and Guy Adami, we discussed the impact of the Federal Reserve’s upcoming Jackson Hole Economic Policy Symposium across various assets classes, including gold, Bitcoin, and stocks.

Fed Chair Jerome Powell is due to speak at Jackson Hole this Friday, August 27 at 10 ET/14 GMT, but the announcement that the event would be moving to a virtual setting may have taken some wind out of the speculative sails that a taper announcement would be coming. After all, if the Fed doesn’t feel comfortable having its annual meeting in person, policymakers likely feel like it’s enough of a threat to the US economy that stimulus efforts are still required.

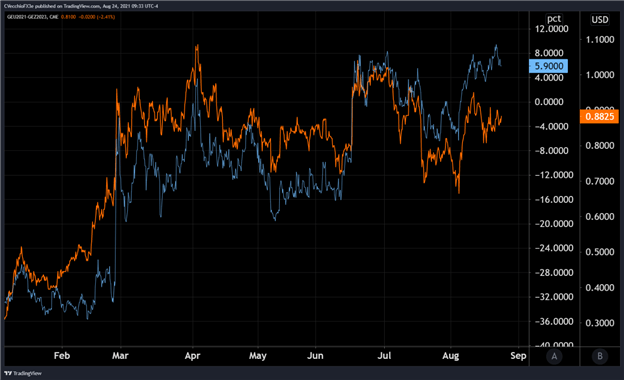

US rates markets are acting consistent with this hypothesis. Tapering isn’t tightening, and while throughout 2021, particularly the past few months, the US Treasury yield curve has been behaving if tapering may be coming soon, Fed rate hike odds (vis-à-vis Eurodollar spreads) have not. Now that the 2s5s10s butterfly is flattening again, markets are downgrading the likelihood that a taper announcement is imminent.

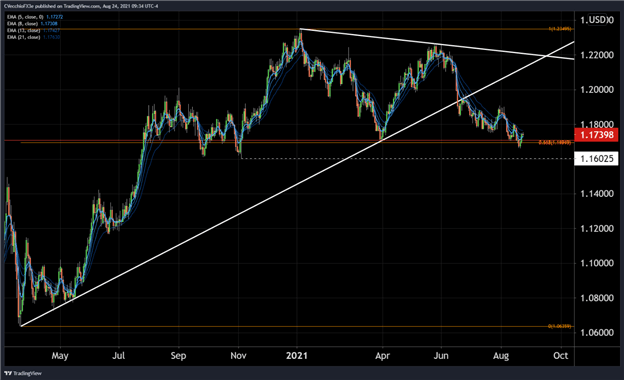

Reduced odds of an imminent Fed taper announcement have spilled across asset classes. The US Dollar (via the DXY Index) may have experienced a false bullish breakout after hitting fresh yearly highs last week, substantiated by the reversal in EUR/USD rates. Ultimately, the rally in EUR/USD may be short-lived, but nothing may frustrate traders more than USD/JPY, which is struggling to produce gains alongside rallying US stock markets as taper odds decline.

*For commentary from Dan Nathan, Guy Adami, and myself on the US Dollar (via the DXY Index), the US S&P 500, gold prices, among others, please watch the video embedded at the top of this article.

CHARTS OF THE WEEK

Eurodollar Futures Contract Spread (September 2021-DECEMBER 2023) versus US 2s5s10s Butterfly: Daily Rate Chart (January 2021 to August 2021) (Chart 1)

GOLD PRICE TECHNICAL ANALYSIS: DAILY CHART (JULY 2020 TO AUGUST 2021) (CHART 2)

EUR/USD PRICE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO AUGUST 2021) (CHART 3)

--- Written by Christopher Vecchio, CFA, Senior Strategist