The Macro Setup Overview:

- US stocks - 2:20, 6:25, 10:30

- Volatility - 8:20, 18:10

- Supply chain disruptions - 12:25

- US yields, FX rates - 15:40, 24:00

Keep Calm and Carry On?

This week’s The Macro Setup, featuring Dan Nathan and Guy Adami, focused on the Federal Reserve's hints at tapering and what that means for US stocks and US Treasury yields, supply chain disruptions impacting semiconductor stocks, and what's keeping both bitcoin and gold traders stay awake at night.

For US stocks, markets are starting to look frothy even from the point of view of soberminded observers. Even as the Fed has suggested it may start to winddown stimulus efforts soon, a drop in US Treasury yields alongside sinking commodity prices has removed some of the near-term pressure for an immediate stimulus withdrawal.

As supply chain disruptions start to ease, embattled sectors may start to gain favor anew - particularly semiconductors. But the other side of supply chain disruptions easing is that the bottleneck pressures around certain commodities have opened up, giving credence to the idea that the Fed may keep rates 'lower for longer.'

Elsewhere, it's curious that bond market volatiltiy is now seen at higher levels than equity market volatility. The long bond is supposed to be the risk-free rate, but the Fed has turned Treasuries into a speculative vehicle, in a sense. Even though US Treasury yields have been heading lower in recent months, this is a warning sign that shouldn't be dismissed lightly.

*For commentary from Dan Nathan, Guy Adami, and myself on the US Dollar (via the DXY Index), the US S&P 500, gold prices, among others, please watch the video embedded at the top of this article.

Charts of the Week

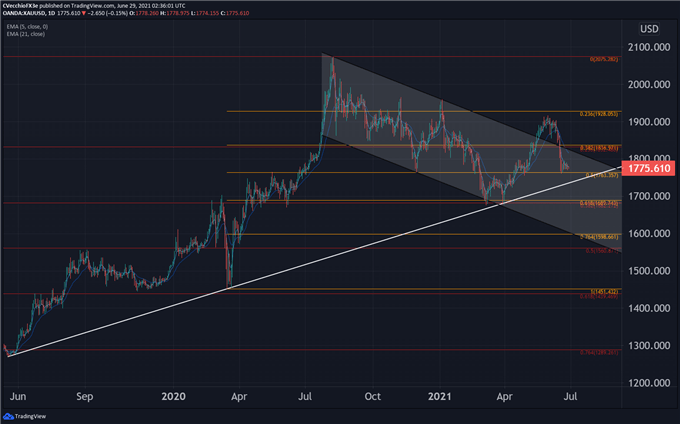

Gold Price Technical Analysis: Daily Chart (May 2019 to June 2021) (Chart 1)

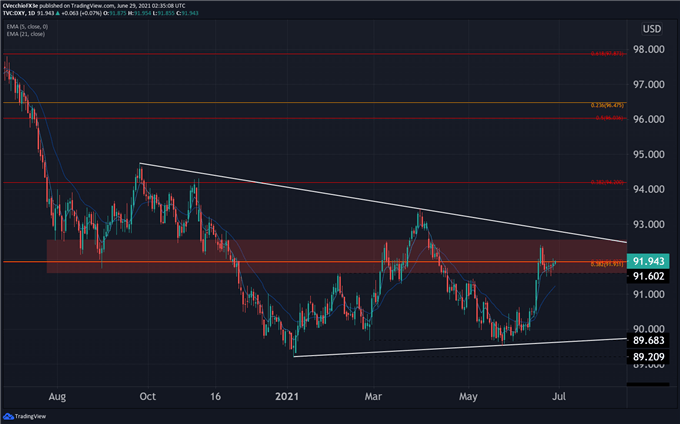

DXY Index Price Technical Analysis: Daily Chart (July 2020 to June 2021) (Chart 2)

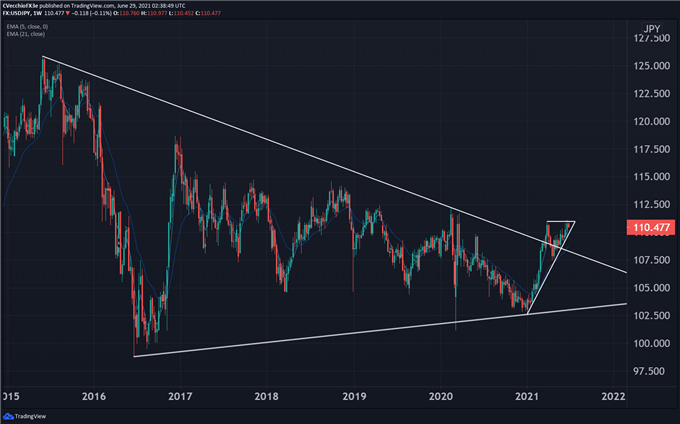

USD/JPY Rate Technical Analysis: Weekly Chart (January 2015 to June 2021) (Chart 3)

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist