Technical Analysis via RSI Key Takeaways:

- Sterling strength pervasive against havens, EUR/GBP breaks to the lowest level since May

- Australian Dollar quietly strengthening against weak FX (JPY, USD)

- US Dollar only strong against JPY, hedge funds favoring further greenback weakness

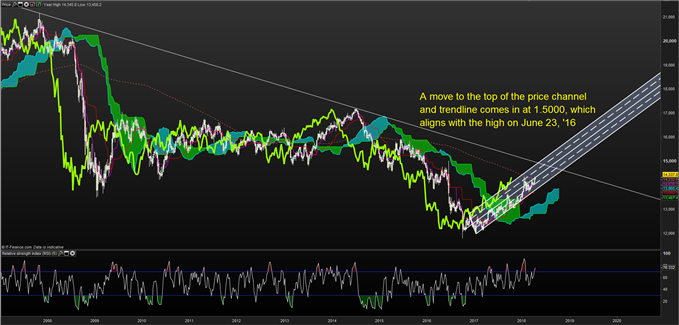

While it’s too early to call ‘Mission Accomplished,’ the spot rate of cable (GBP/USD) is testing the 200-week moving average. The 200-WMA currently sits at 1.4231, and a weekly close above could make it even more difficult for institutions to hold their rare GBP short positions.

While spot cable at 1.4335 is still a long way away from the Brexit vote day high of 1.5018, a break above the 200-WMA would clear a massive hurdle.

Cable Moving Higher Within Bullish Channel

Interested in learning how to manage your trades better? Check out our free trading guides here

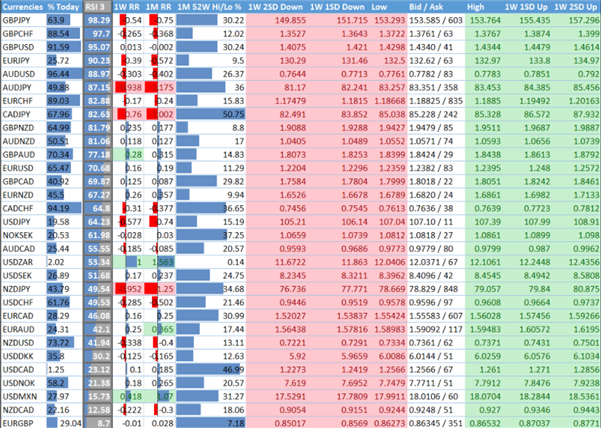

Overbought FX Pairs and Individual Currencies as of April 16, 2018

Data source: Bloomberg

Current FX Opportunities in Focus

A quick look above, and you can see that the 3-top overbought pairs (GBP/JPY, GBP/CHF, and GBP/JPY) per RSI(3) show haven currency weakness like CHF and JPY and Pound Sterling strength.

Typically, a weak JPY or CHF is a sign that risk sentiment is doing well, and the rise in global indices backs that view up as of Monday. US stocks continue to perform well as trade war fears recede and earnings season starts strong with the US indices higher by ~1%.

On the opposite side of the distribution, 2 of the top-3 weakest pairs per RSI(3) have show Non-USD North Amercian currency strength in the CAD and MXN alongside relative EUR weakness against the GBP.

GBP Strength – Seen Clearest Against Haven Currencies

Chart Source: ProRealtime, IG UK Price Feed. Created by Tyler Yell, CMT

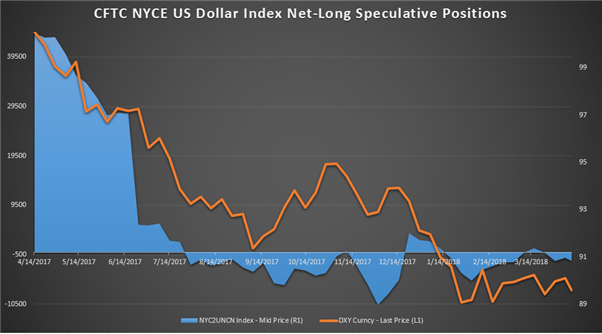

USD Weakness A Theme That Hedge Funds Love

Recently, markets read a tweet from US President Trump that blamed China and Russia for playing the ‘Currency Devaluation game.’ Despite complaining about the weakness of other currencies as the US is set to raise rates further, it was the USD that continued to weaken at the start of the week as the US yield curve continues to push flatter making the Fed’s long-term job more difficult.

US Dollar Index (DXY) Hanging By A Thread

Chart Source: ProRealtime, IG UK Price Feed. Created by Tyler Yell, CMT

In addition to the fundamentals, hedge fund positioning is showing an aggressive US Dollar short position in play. Per the CFTC commitment of traders report, the US Dollar Index (DXY) net-long position is at the lowest levels since January 2013.

Positioning Data Shows Longs Are Nowhere To Be Found

Data source: Bloomberg

As short positions on the USD outnumber bullish wagers by the most since Q1 2013, traders will continue to see if the rise in commodities and commodity currency can help Canadian Dollar, Australian Dollar, and New Zealand Dollar Bulls.

Keep an Eye on High Beta FX

On the other end of the spectrum in the FX-world to haven currencies are high-beta FX like commodity currencies such as the AUD/USD, NZD/USD, USD/CAD, and USD/MXN.

MXN Has Shown Impressive Resilience Against USD

Chart Source: ProRealtime, IG UK Price Feed. Created by Tyler Yell, CMT

If you’re of the view that MXN strength is likely to continue, keep an eye on USDMXN as it may accelerate to prior key levels in the 17.6-17.3 zone on a firm break below 18. MXN would likely appreciate taking the pair lower if the general risk-on tone holds as positive NAFTA developments emerge and USD weakness resumes.

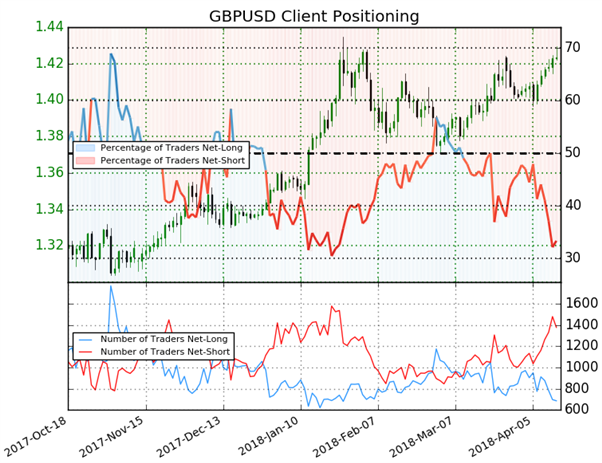

Looking To Add More To This Analysis? Try IG Client Sentiment

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bullish contrarian trading bias (emphasis mine.)

Access Real-Time Sentiment Analysis Here

Explanation of Columns Above:

The key column per this report is the RSI(3) column, which is showing the current calculation of the short-term RSI on key currency pairs. The default RSI setting is 14, which makes up nearly 3-weeks of trading data. Naturally, a 3-period RSI is much more sensitive to current moves in the market as opposed to looking over the last 14-days. Short term momentum helps short-term traders find higher probability trading opportunities.

Learn more about using and trading with the Relative Strength Index here

How I Use This Data In My Trading:

Being a fan of trading in the direction of the trend has taught me over the years to look for opportunities at a favorable price to enter in the direction of the trend. When using this data, I am looking for an oversold reading in a well-defined uptrend to identify favorable buying opportunities or an overbought reading in a well-defined downtrend to identify favorable selling opportunities.

Traditionally, a reading above 70 on RSI favors an overbought reading, while a reading below 30 signals an oversold reading. It’s worth noting that reversals are rare, so you want to be as aware of a new normal or trend breakout, as you do an extreme counter-trend reading that may present you an excellent risk-adjusted trading opportunity.

New to FX trading? No worries, we created this guide just for you.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell

Join Tyler’s distribution list.