Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list: Price & Time

Talking Points

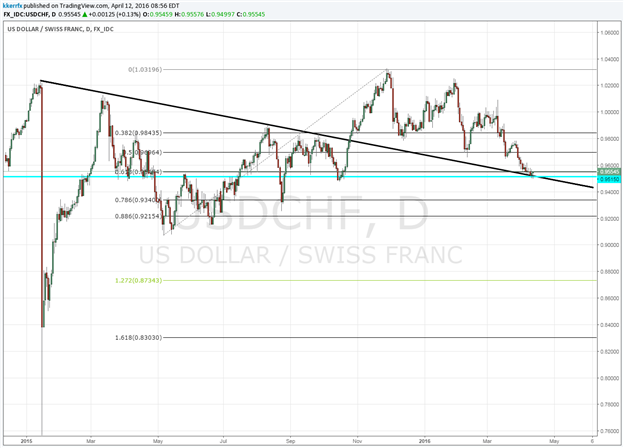

- USD/CHF probing key support confluence

- Important breakdown or recovery looms

USD/CHF - Don’t Give Up on the Greenback Just Yet

One of the biggest questions plaguing FX traders at the moment is whether the great USD bull market of the past few years is over or at least about undergo a much deeper correction. Given the USD weakness exhibited in things like USD/JPY and USD/SEK (traditional broader USD leaders) it is easy to come to the conclusion that the dollar has broken. I am a little more resolute and am looking for more confirmation before turning completely negative on the Greenback.

What is the #1 mistake most FX traders make? Find out HERE.

One of the charts I am watching closely is USD/CHF. Now if you have read this corner over the past few years you will know the franc has not been a favorite vehicle. Most of that has to do with the fact that after the SNB abandoned the peg in EUR/CHF nobody really knew where CHF exchange rates traded in the immediate aftermath. For someone like me that values symmetry that has been posed a bit of an analytical problem. Luckily time heals all wounds and that applies to charts as well. Since the fiasco in January of last year, we slowly but surely have repopulated the daily chart with credible price data and USD/CHF looks to be at a key inflection points in terms of price. I am focused on the zone between .9500 and .9550. This area marks a nice confluence of several key support levels that include the 61.8% retracement of the May - November advance, an internal trendline connecting last year’s January, August and September highs and the 8th square root relationship of the 2015 high. A clear break of this zone would confirm that a more important breakdown is underway. If USD/CHF can hold above this zone (not settle below) then the dollar probably still has some fight in it left and I wouldn’t be surprised to see a more important push higher develop in the days ahead. A close over .9600 would help corroborate this thinking.

Looking for real-time positioning data? Find out HERE

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX