Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list: Price & Time

Talking Points

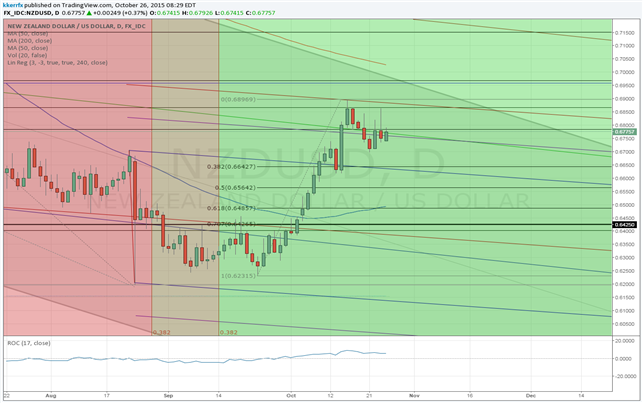

- NZD/USD at important time retracement this week

- Month-to-date high remains key pivot

Unfamiliar with Fibonacci Relationships? Learn more about them HERE

The reversal last quarter in NZD/USD occurred right around the 38% retracement in time of the advance between the low recorded in 2000 and the all-time high recorded in 2011. The advance that has followed has been fairly swift with the exchange rate rallying some 10% over the past month. The timing relationship at the low and the aggressiveness of the proceeding advance obviously allows for the possibility of a much more important move higher continuing from here, but before getting too bullish on the Kiwi I would like to see how the exchange rate contends with the several key timing hurdles over the next few weeks.

The first bit of “time resistance” occurs this week as we are at the 61.8% retracement of the time elapsed between the 2012 low and the 2014 secondary high. Relationships related to this advance have already proven influential as the second quarter high this year occurred right at the 38% retracement in time of this move. As we move into the first weeks of November, I see several more timing tests as the exchange rate will be an Armstrong Pi related cycle of 4.3 years from the 2011 all-time high and a geometrically significant 1273 calendar days from the May 2012 low – among other things. If the broader downtrend in place since July of 2014 is going to reassert itself then this is the time from where I would expect it to do so.

Price is another matter as I will need to see what spot is doing into these timing windows, but I see important pockets of resistance at .6880, .6970 and around .7150. Another scenario worth considering is that exchange rate could put in some sort of secondary low over the next few weeks. However, I would need to see some material weakness develop in the Kiwi to take this possibility more seriously.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX